>>508286509

Is the yuan the world's default reserve currency denomination?

Read the archive.4plebs topic posted above

It's no solely about 'demise of the dollar' (<--something taking its place) or 'muh BRICS', it is about the global liquidity drying up and the total dependence of current system on USD which can produce a near-instantaneous credit freeze

>as would have occurred in Aug-Sept 2019 without almost $1T in bailouts (followed soon after by covid global lockdown and $12T more in liquidity to the dried-up system)

>as would have occurred in 2007-8 without those bailouts

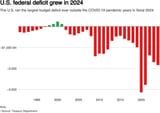

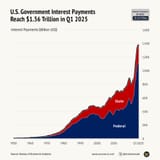

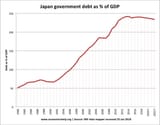

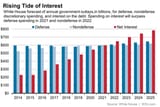

Main problem rn, is that compared to 2019 or 2008 the total debt has more than tripled in magnitude and (as posted upthread) governments are far outspending themselves just to pay interest.

USD is the global default reserve currency, therefore confidence in that denomination and also U.S. treasuries is dependent upon the world's perceived confidence in U.S. government solvency.

That is why the debt (bond) market has a sales problem : Nobody wants to buy the debt

nothing to be enthusiastic about U.S. treasuries (or the USD), it's meh

6/22/2025, 5:31:16 AM

No.508279080

[Report]

>>508279708

>>508282707

>>508282935

>>508283030

>>508283038

>>508283136

>>508283155

>>508283192

>>508287916

>>508287966

>>508289263

>>508289521

>>508290508

>>508299480

6/22/2025, 5:31:16 AM

No.508279080

[Report]

>>508279708

>>508282707

>>508282935

>>508283030

>>508283038

>>508283136

>>508283155

>>508283192

>>508287916

>>508287966

>>508289263

>>508289521

>>508290508

>>508299480