>>520945793

>debt note fiat currency

>might as well not exist

Correct, memeflag.

The real problem worldwide is that the global system depends not only on debt and speculative debt instruments, but that it depends on a single default reserve currency denomination : USD (treasuries)

Nobody wants to buy the debt

https://archive.4plebs.org/pol/thread/500310690

This is an important significant imminent problem (not some theoretical blogslop) because, a system that is globally founded in its entirety on debt, requires global confidence in the debt market to remain steady and stable. Debt aka bonds need to remain in strong demand (which they are not rn), and moreover the nation which issues the world's global reserve currency denomination—and the treasuries so denominated—needs to be viewed with confidence. Which it also currently is not (with ever-rising $2T/annum budgets and deficits outpaced by Interest Payments); the United States at current spending, 'printing' rates is headed for Total Default in four years.

4chan Search

19 results for "94d097db57a39b51ec4a536645b1ec03"

>>520721344

>TrumpBiden printed

*Congress*

the United States Congress is the branch of government holding the purse strings on spending

It's up to the 535 members of Congress, how much money is spent. Not the president

Also, the U.S. government doesn't 'print' money and neither do the banks. It's all debt. Debt note fiat currency *ISSUED AS DEBT* on which Interest Payments must be made

(You)'re just another fucking midwit &#@mming 4chan like all the rest, thinks he's 'smart'

>TrumpBiden printed

*Congress*

the United States Congress is the branch of government holding the purse strings on spending

It's up to the 535 members of Congress, how much money is spent. Not the president

Also, the U.S. government doesn't 'print' money and neither do the banks. It's all debt. Debt note fiat currency *ISSUED AS DEBT* on which Interest Payments must be made

(You)'re just another fucking midwit &#@mming 4chan like all the rest, thinks he's 'smart'

>>520681607

Global debt market is going to collapse; this will be contingent upon the world's confidence in USD-denominated treasuries and whether the U.S. can sustain $2T/annum spending by its Congress, because America's total default looms within 4 years from today due to Interest Payments

Global debt market is going to collapse; this will be contingent upon the world's confidence in USD-denominated treasuries and whether the U.S. can sustain $2T/annum spending by its Congress, because America's total default looms within 4 years from today due to Interest Payments

>>516093628

>national debt

That wasn't what my post was referencing but yes, correct. These 'cycles' are pushed by the central banks and the tandem gigaexpansion (as you point out with covid, a massive boost) of monetary(central bank+treasury "moneyprinting") and fiscal(gov spending) policies simply can't continue. United States has about 4 years until total default, the $2T/annum deficits with Interest Payments already have outstripped discretionary spending. The magnitude of the gigabubble expansion has crossed a rubicon. Only way to even 'stay ahead' of the Interest Payment tidal wave is to get annual GDP growth up to around 4 or 5 percent from its current anemic ~2 percent... but even that is going to vastly mega-inflate the debt which is over $37T rn. Four more years and reach $50-55T, that's Total Default.

Global debt market and confidence in USD treasuries (the default global reserve) will have imploded long prior to that

>national debt

That wasn't what my post was referencing but yes, correct. These 'cycles' are pushed by the central banks and the tandem gigaexpansion (as you point out with covid, a massive boost) of monetary(central bank+treasury "moneyprinting") and fiscal(gov spending) policies simply can't continue. United States has about 4 years until total default, the $2T/annum deficits with Interest Payments already have outstripped discretionary spending. The magnitude of the gigabubble expansion has crossed a rubicon. Only way to even 'stay ahead' of the Interest Payment tidal wave is to get annual GDP growth up to around 4 or 5 percent from its current anemic ~2 percent... but even that is going to vastly mega-inflate the debt which is over $37T rn. Four more years and reach $50-55T, that's Total Default.

Global debt market and confidence in USD treasuries (the default global reserve) will have imploded long prior to that

>>515139359

>>515139693

'Capitalism' died and permanently went to heaven in 2008, after which all HNW entities, corporations, sovereign governments are totally and entirely dependent on infinite supplies of debt note fiat currency from private central banks to keep from instant implosion.

Whatever this is 2009-2025, it's not 'capitalism'.

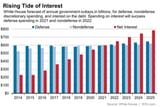

The real problem (from a fiscal/gov spending p.o.v.) is Interest Payments on the national debt which are a tsunami inundating federal discretionary spending.

>>515139693

'Capitalism' died and permanently went to heaven in 2008, after which all HNW entities, corporations, sovereign governments are totally and entirely dependent on infinite supplies of debt note fiat currency from private central banks to keep from instant implosion.

Whatever this is 2009-2025, it's not 'capitalism'.

The real problem (from a fiscal/gov spending p.o.v.) is Interest Payments on the national debt which are a tsunami inundating federal discretionary spending.

>what the Trump administration wants

Already described-explained in lower part of post >>515012155 <--here

That's the administration's plan. Skeptical that it keeps ahead of the tsunami of Interest Payments that is swamping discretionary spending <--and will lead to total Default within four years if annual U.S. GDP growth can't expand fast enough to "grow out of" the debt+interest

Yes, this supply-side plan is yet another giga-expansion of the already untenable magnitude debt (but keeps the Interest Payments relatively at bay for a few more years, assuming it even works)

>keep expanding, keep expanding we'll grow our way out of it: and be in even greater magnitude debt as a result

Already described-explained in lower part of post >>515012155 <--here

That's the administration's plan. Skeptical that it keeps ahead of the tsunami of Interest Payments that is swamping discretionary spending <--and will lead to total Default within four years if annual U.S. GDP growth can't expand fast enough to "grow out of" the debt+interest

Yes, this supply-side plan is yet another giga-expansion of the already untenable magnitude debt (but keeps the Interest Payments relatively at bay for a few more years, assuming it even works)

>keep expanding, keep expanding we'll grow our way out of it: and be in even greater magnitude debt as a result

>>513808306

>>513808396

There isn't one.

also the main problem (yes, debt's a huge problem on its own) is Interest Payments which now outstrip discretionary spending.

What the OP doesn't comprehend or understand is the incoming administration does have a plan, if an ambitious and extremely long shot one.

If ? the U.S. can get its annual GDP increase to the 4 or 5 percent range in the next 18 months, out of its current anemic ~2% then there might ?? be a chance that Congress can continue its $2T/annum spending sprees and the United States can keep just enough ahead of the Interest Payment tsunami engulfing our entire budget to grow our way out of the debt.

If not, then the global bond (aka debt) market collapses which it's already on the brink of rn

Confidence and stability in the global bond market, in which U.S. treasuries aka the USD denomination is the virtual entirety and foundation of, must be maintained. Because the global economic system is backed by absolutely nothing other than debt.

Global debt market has been more volatile and unstable in the past few years than in half a century and, half a century ago there was not (nor has there ever been in global human history) the degree of dependence on a single default world reserve currency denomination.

>>513808396

There isn't one.

also the main problem (yes, debt's a huge problem on its own) is Interest Payments which now outstrip discretionary spending.

What the OP doesn't comprehend or understand is the incoming administration does have a plan, if an ambitious and extremely long shot one.

If ? the U.S. can get its annual GDP increase to the 4 or 5 percent range in the next 18 months, out of its current anemic ~2% then there might ?? be a chance that Congress can continue its $2T/annum spending sprees and the United States can keep just enough ahead of the Interest Payment tsunami engulfing our entire budget to grow our way out of the debt.

If not, then the global bond (aka debt) market collapses which it's already on the brink of rn

Confidence and stability in the global bond market, in which U.S. treasuries aka the USD denomination is the virtual entirety and foundation of, must be maintained. Because the global economic system is backed by absolutely nothing other than debt.

Global debt market has been more volatile and unstable in the past few years than in half a century and, half a century ago there was not (nor has there ever been in global human history) the degree of dependence on a single default world reserve currency denomination.

>>513628090

>Greece flag

(You) were being sarcastic but yes Interest Payments aren't fake

they're Real

and are the biggest problem with all that "fake" debt note fiat currency and "fake" national debt/deficits "it's all fake" amirite

>Greece flag

(You) were being sarcastic but yes Interest Payments aren't fake

they're Real

and are the biggest problem with all that "fake" debt note fiat currency and "fake" national debt/deficits "it's all fake" amirite

>>513598302

Idk and neither do top financial experts.

Nobody knows. But many are signaling loud warnings.

(one mere example, there exist thousands of others for several years now)

https://archive.4plebs.org/pol/thread/500310690

another (tangential)

https://archive.4plebs.org/pol/thread/506316301

Debt (globally not just the U.S.) is out of control esp. over the past 6 years, more importantly (from solely a fiscal perspective) the U.S. continues $2T/annum deficits for the foreseeable future while simultaneously, Interest Payments are outstripping discretionary spending.

From a macro p.o.v. this means: the U.S. (<--on whose currency denomination entire world depends as default reserve) must achieve an annual gdp growth rate of greater than its current anemic ~2 percent/annum, up to around 4 or 5 (or more) annually. If that doesn't occur in the next 8 to 12 months i.e. we don't kick the *real* annual U.S. gdp growth up into the 3 or 4 percent growth range, it's going to be impossible to keep propping up the already-DOA bond market that no one is buying or wants to buy, further eroding global confidence in the denomination (*Hint*: global confidence in treasuries is more important than confidence in USD) and the U.S. gov is then imminently going to impact the Total Default brick wall.

Idk and neither do top financial experts.

Nobody knows. But many are signaling loud warnings.

(one mere example, there exist thousands of others for several years now)

https://archive.4plebs.org/pol/thread/500310690

another (tangential)

https://archive.4plebs.org/pol/thread/506316301

Debt (globally not just the U.S.) is out of control esp. over the past 6 years, more importantly (from solely a fiscal perspective) the U.S. continues $2T/annum deficits for the foreseeable future while simultaneously, Interest Payments are outstripping discretionary spending.

From a macro p.o.v. this means: the U.S. (<--on whose currency denomination entire world depends as default reserve) must achieve an annual gdp growth rate of greater than its current anemic ~2 percent/annum, up to around 4 or 5 (or more) annually. If that doesn't occur in the next 8 to 12 months i.e. we don't kick the *real* annual U.S. gdp growth up into the 3 or 4 percent growth range, it's going to be impossible to keep propping up the already-DOA bond market that no one is buying or wants to buy, further eroding global confidence in the denomination (*Hint*: global confidence in treasuries is more important than confidence in USD) and the U.S. gov is then imminently going to impact the Total Default brick wall.

>>513272058

>on its last legs

The global debt-based economic model, which began in 1944 with the Bretton Woods agreement, is on its last legs because nobody wants to buy the debt. The tandem gigaexpansion of monetary (treasury+central bank "moneyprinting") and fiscal(gov spending) policies has reached a rubicon, where the sheer magnitude of debt issuance can not be bought or even absorbed.

Interest Payments on U.S. national debt (now @ $37T) exceed and outstrip discretionary spending in a rising tsunami.

Unearned income has become the primary method by which the global economy's top HNW entities (including corporations, govs, banking, phrmaceuticals and insurance), using debt instruments and debt note fiat currencies, are creating wealth and increasing GDP (which is less and less comprised of actual goods/serices while more and more comprised of Financialized debt and speculative instruments). Global debt topped $255 trillion in 2019 and $307 trillion in 2023, more than three times the amount of all global economic output. Total debt levels and deficit spending of the past 30 years has eclipsed that of the past few centuries of western civilization, and absurdly low and negatie interest rate borrowing costs have incentivized national governments to no longer borrow on the expectation that they will repay, but rather the expectation that they will refinance.

https://en.wikipedia.org/wiki/Derivative_(finance)

https://en.wikipedia.org/wiki/Financialization

>on its last legs

The global debt-based economic model, which began in 1944 with the Bretton Woods agreement, is on its last legs because nobody wants to buy the debt. The tandem gigaexpansion of monetary (treasury+central bank "moneyprinting") and fiscal(gov spending) policies has reached a rubicon, where the sheer magnitude of debt issuance can not be bought or even absorbed.

Interest Payments on U.S. national debt (now @ $37T) exceed and outstrip discretionary spending in a rising tsunami.

Unearned income has become the primary method by which the global economy's top HNW entities (including corporations, govs, banking, phrmaceuticals and insurance), using debt instruments and debt note fiat currencies, are creating wealth and increasing GDP (which is less and less comprised of actual goods/serices while more and more comprised of Financialized debt and speculative instruments). Global debt topped $255 trillion in 2019 and $307 trillion in 2023, more than three times the amount of all global economic output. Total debt levels and deficit spending of the past 30 years has eclipsed that of the past few centuries of western civilization, and absurdly low and negatie interest rate borrowing costs have incentivized national governments to no longer borrow on the expectation that they will repay, but rather the expectation that they will refinance.

https://en.wikipedia.org/wiki/Derivative_(finance)

https://en.wikipedia.org/wiki/Financialization

>>511385464

>bunkers

They are part of the controllers' self-made mythology that they, alone, are the "rulers" and have the power to direct the system which they created.

Unfortunately for central banks, the debt-based economic model is not under their control: it is under the control of mathematics

>bunkers

They are part of the controllers' self-made mythology that they, alone, are the "rulers" and have the power to direct the system which they created.

Unfortunately for central banks, the debt-based economic model is not under their control: it is under the control of mathematics

>>509267758

>Germany flag

>'It's a fictional concept'

are Interest Payments fictional?

Tell that to the global bond market (on brink of total collapse)

https://archive.4plebs.org/pol/thread/500310690

>Germany flag

>'It's a fictional concept'

are Interest Payments fictional?

Tell that to the global bond market (on brink of total collapse)

https://archive.4plebs.org/pol/thread/500310690

>>509068651

>stop printing money

the post-1970s Financialized global economy relies upon ever-increasing debt issuance to keep going, it can't go in the opposite direction

*Tandem* gigaexpansion of fiscal(gov spending) and monetary(central bank + treasury "moneyprinting") has reached a rubicon with the world's issuer of the default reserve currency: Interest Payments on the debt now exceed discretionary spending

Six years ago December 2019 (just before covid lockdown and issuance of $12T more in liquidity for a collapsing global debt market, a collapse we are still in rn)

https://www.youtube.com/watch?v=SMHQaxd5N-Q

>stop printing money

the post-1970s Financialized global economy relies upon ever-increasing debt issuance to keep going, it can't go in the opposite direction

*Tandem* gigaexpansion of fiscal(gov spending) and monetary(central bank + treasury "moneyprinting") has reached a rubicon with the world's issuer of the default reserve currency: Interest Payments on the debt now exceed discretionary spending

Six years ago December 2019 (just before covid lockdown and issuance of $12T more in liquidity for a collapsing global debt market, a collapse we are still in rn)

https://www.youtube.com/watch?v=SMHQaxd5N-Q

>>508281139

>Interest payments now exceed U.S. defense spending

Correct.

Interest Payments on the U.S. debt now exceed all discretionary (not solely military) spending

>Interest payments now exceed U.S. defense spending

Correct.

Interest Payments on the U.S. debt now exceed all discretionary (not solely military) spending

correct, the tandem gigaexpansion of fiscal(gov spending—controlled by U.S. Congress purse strings) and monetary(Treasury+central bank "moneyprinting") policies has reached a rubicon.

Interest Payments alone on the debt now swamp discretionary spending includ8ng total military, in a tsunami

Nobody is buying the debt.

Global debt (bond) market is going to respond, soon

Interest Payments alone on the debt now swamp discretionary spending includ8ng total military, in a tsunami

Nobody is buying the debt.

Global debt (bond) market is going to respond, soon