Anonymous

(ID: oCzdVuF4)

7/2/2025, 11:45:45 AM

No.509294504

[Report]

>>509294698

>>509294818

>>509294904

>>509295143

>>509295183

>>509295304

>>509295417

>>509295492

>>509295579

>>509295639

>>509295896

>>509299375

>>509299465

>>509299482

>>509299621

>>509299636

>>509300224

>>509300445

>>509300596

>>509300908

>>509301011

>>509301093

>>509301116

>>509301451

>>509304556

>>509305863

>>509306009

>>509306211

>>509307213

>>509307231

>>509307825

>>509307851

>>509309259

>>509309844

>>509311432

>>509311534

>>509311628

>>509315009

>>509315161

>>509315361

>>509317274

>>509317287

>>509320603

>>509320716

>>509321081

>>509321161

>>509321316

>>509321460

>>509322716

>>509322818

>>509322994

>>509323103

>>509323155

>>509323161

>>509323194

>>509323367

>>509323914

>>509324109

>>509324178

>>509324477

>>509324648

>>509325342

>>509325926

>>509325976

>>509326090

>>509326091

>>509326307

>>509326516

>>509327600

>>509328084

>>509328238

>>509328367

>>509328622

>>509328655

>>509328744

>>509328821

>>509329217

7/2/2025, 11:45:45 AM

No.509294504

[Report]

>>509294698

>>509294818

>>509294904

>>509295143

>>509295183

>>509295304

>>509295417

>>509295492

>>509295579

>>509295639

>>509295896

>>509299375

>>509299465

>>509299482

>>509299621

>>509299636

>>509300224

>>509300445

>>509300596

>>509300908

>>509301011

>>509301093

>>509301116

>>509301451

>>509304556

>>509305863

>>509306009

>>509306211

>>509307213

>>509307231

>>509307825

>>509307851

>>509309259

>>509309844

>>509311432

>>509311534

>>509311628

>>509315009

>>509315161

>>509315361

>>509317274

>>509317287

>>509320603

>>509320716

>>509321081

>>509321161

>>509321316

>>509321460

>>509322716

>>509322818

>>509322994

>>509323103

>>509323155

>>509323161

>>509323194

>>509323367

>>509323914

>>509324109

>>509324178

>>509324477

>>509324648

>>509325342

>>509325926

>>509325976

>>509326090

>>509326091

>>509326307

>>509326516

>>509327600

>>509328084

>>509328238

>>509328367

>>509328622

>>509328655

>>509328744

>>509328821

>>509329217

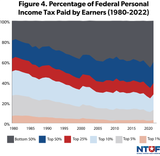

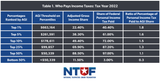

>Tax the rich

Why does this make rightoid boot lickers seethe so much?

Why does this make rightoid boot lickers seethe so much?