Why do Americans keep complaining about the economy when the stock market is hitting all-time highs? Literally just log into your investment accounts and check your balance - you're doing great. Why is there so much whining during what are very close to ideal economic conditions?

Anonymous

(ID: 3trm4e7f)

9/5/2025, 1:04:28 PM

No.514864356

[Report]

>>514864452

>>514884895

9/5/2025, 1:04:28 PM

No.514864356

[Report]

>>514864452

>>514884895

>>514864246 (OP)

These trannies lost and are mad lol

Anonymous

(ID: WUAwg62d)

9/5/2025, 1:06:54 PM

No.514864452

[Report]

>>514864812

9/5/2025, 1:06:54 PM

No.514864452

[Report]

>>514864812

>>514864356

lost what? troon shit is still legal under trump, even for kids.

Anonymous

(ID: 3trm4e7f)

9/5/2025, 1:13:54 PM

No.514864812

[Report]

>>514867504

9/5/2025, 1:13:54 PM

No.514864812

[Report]

>>514867504

>>514864452

Cope, seethe, dilate

Anonymous

(ID: 0YClkSeF)

9/5/2025, 1:23:07 PM

No.514865256

[Report]

9/5/2025, 1:23:07 PM

No.514865256

[Report]

>>514864246 (OP)

That's the same money that's building ballrooms and tennis courts at the White house and put fuel in Jeff's jet.

>>514864246 (OP)

A cheeseburger is $10 and a new truck is $100,000. You call that ideal?

Anonymous

(ID: nd6TrBt4)

9/5/2025, 1:25:52 PM

No.514865435

[Report]

9/5/2025, 1:25:52 PM

No.514865435

[Report]

>>514864246 (OP)

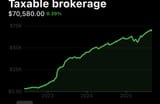

Yeah yesterday was a good day. Hopefully it keeps up.

>>514865331

Obviously, consumers would prefer lower consumer prices, but considering that wages and investments are soaring even more quickly than inflation, it's simply not a real problem.

Anonymous

(ID: MKVzzZ1A)

9/5/2025, 1:27:02 PM

No.514865497

[Report]

>>514866500

9/5/2025, 1:27:02 PM

No.514865497

[Report]

>>514866500

>>514864246 (OP)

>Wall St. Jews are doing great!

>Never mind that the cost of groceries is spiraling out of control

>never mind that a new car starts at $50K

>Never mind that more and more people are going into credit card debt just to survive

>Never mind that the job market is fucked

Anonymous

(ID: xTxIpeXT)

9/5/2025, 1:28:00 PM

No.514865545

[Report]

>>514866556

9/5/2025, 1:28:00 PM

No.514865545

[Report]

>>514866556

>>514864246 (OP)

>>514865468

you can tell by the price of gold in dollars that inflation is high

>>514865468

>inflation, it's simply not a real problem.

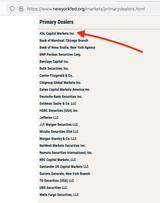

Deflation and inflation and other economic terms are FUCKING MEANINGLESS when one class of persons HAS FIRST ACCESS TO and IS BEING PAID FOR the issuance of any newly-created currency. Money does not mean the same thing or have the same scarcity (or have the same value) for all persons in the economy. As some do not earn their money (via real productivity), money is more liquid and less valuable for them, as they have exclusive first-access to the newly-issued currency and they also decide TO WHOM it is allocated via our current debt-based NYFed primary dealer financial system.

As long as we have a cartel of private banks getting paid to issue the currency, the FEDERAL RESERVE NOTE will lose EVEN MORE value for those of us that truly do earn it via productivity.

IT IS THOSE OF US WORKING that choose to prop up this class of parasitic, skillless invalids debauching our currencies worldwide via the Federal Reserve and its increasingly-worthless private currency, the Federal Reserve Note.

US Treasury-issued, debt-free, fiat US Notes are the already-legal, interest-free sovereign currency solution to a debt-based currency and monetary policy parasite, the Federal Reserve Uniparty.

Why do all of the proposed solutions to the debt and deficit spending only include the NYFed?

1 more congressional Public Issues and Cash Management Bills for deficit spending uses the NYFed's primary dealers to buy that new bond debt

2 US Treasury buybacks of treasuries from NYFed primary dealers uses the NYFed as a fiscal agent

and

3 a trillion dollar platinum coin would be, of course, held by the NYFed

kek

Anonymous

(ID: N7oCx/oe)

9/5/2025, 1:41:11 PM

No.514866251

[Report]

9/5/2025, 1:41:11 PM

No.514866251

[Report]

>>514864246 (OP)

Niggers complain for more gibs. Wiggers complain for more meth spending money. Women complain because tiktok told them to complain. Faggots complain because they want to touch children. Almost no one knows what is really happening with the economy. They just like whining.

Oh, and gas all jews.

Anonymous

(ID: AODtOKS6)

9/5/2025, 1:41:27 PM

No.514866258

[Report]

9/5/2025, 1:41:27 PM

No.514866258

[Report]

>>514865468

>wages and investments are soaring

Not wages. Thats verifiably false, anon. I can also personally tell you that salary ranges have hardly moved due to inflation.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 1:42:43 PM

No.514866323

[Report]

9/5/2025, 1:42:43 PM

No.514866323

[Report]

>>514866127

>as they have exclusive first-access to the newly-issued currency and they also decide TO WHOM it is allocated via our current debt-based NYFed primary dealer financial system.

Anonymous

(ID: w8bAlCna)

9/5/2025, 1:43:45 PM

No.514866376

[Report]

>>514866427

9/5/2025, 1:43:45 PM

No.514866376

[Report]

>>514866427

>>514865468

>wages are soaring

Huh?

Anonymous

(ID: aXXPiRFN)

9/5/2025, 1:44:26 PM

No.514866419

[Report]

>>514864246 (OP)

Chude into stocks are traders who keep jumping around and losing money

Anonymous

(ID: cVhqXaNB)

9/5/2025, 1:44:34 PM

No.514866427

[Report]

>>514885704

>>514885746

9/5/2025, 1:44:34 PM

No.514866427

[Report]

>>514885704

>>514885746

>>514866376

>>wages are soaring

kek

for the Fed lol

Anonymous

(ID: cVhqXaNB)

9/5/2025, 1:45:34 PM

No.514866481

[Report]

9/5/2025, 1:45:34 PM

No.514866481

[Report]

Anonymous

(ID: N7oCx/oe)

9/5/2025, 1:45:55 PM

No.514866500

[Report]

>>514879789

9/5/2025, 1:45:55 PM

No.514866500

[Report]

>>514879789

>>514865497

>Wall St. Jews are doing great!

Yes, the jew grift is doing well.

>Never mind that the cost of groceries is spiraling out of control

No, they aren't. A few tnhings are up because of shitfaggot policies. Like beef are going up because homosexuals in the Biden admin cut off grazing lands.

>never mind that a new car starts at $50K

Conscious decision by the car companies, assuming everyone would just jump to 7 or 10 year loans. Not all jews are smart and this scheme has backfired.

>Never mind that more and more people are going into credit card debt just to survive

"Survive" doesn't include five streaming services and daily starbucks.

>Never mind that the job market is fucked

IT and desk jockey markets are mega-fucked, thanks to poo and jew schemes. The rest of the market is picking up nicely.

Stop being a faggot.

Anonymous

(ID: EyybizB7)

9/5/2025, 1:46:05 PM

No.514866509

[Report]

9/5/2025, 1:46:05 PM

No.514866509

[Report]

>>514864246 (OP)

I love how good the stock market is doing. In fact, I love it so much I bought a new rifle the other day. Nothing makes me happier than range training while thinking about how good wall street investors portfolios are doing :^)

Anonymous

(ID: N7oCx/oe)

9/5/2025, 1:46:59 PM

No.514866556

[Report]

9/5/2025, 1:46:59 PM

No.514866556

[Report]

>>514865545

Another retard. The dollar is being intentionally attacked to being it down. It isn't inflation. Three decades of a strong dollar policy has fucked us bad.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 1:48:17 PM

No.514866621

[Report]

9/5/2025, 1:48:17 PM

No.514866621

[Report]

lol

18,000 more people in 2021 than 2020 made $10M or more

the year we were all locked down

the reason the economy keeps churning along is b/c the US taxpayers are like a giant fucking engine that is going to bulldoze right the fuck over the Fed

Anonymous

(ID: qhWgbzho)

9/5/2025, 1:50:18 PM

No.514866729

[Report]

9/5/2025, 1:50:18 PM

No.514866729

[Report]

>>514864246 (OP)

i know lol why would normal people bitch about grocery prices when hedge funds managers are stacking when has that ever happened in the history of like, ever

Anonymous

(ID: cVhqXaNB)

9/5/2025, 1:51:00 PM

No.514866762

[Report]

>>514866836

>>514867291

9/5/2025, 1:51:00 PM

No.514866762

[Report]

>>514866836

>>514867291

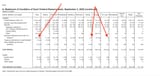

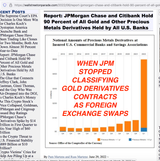

<<----this is margin trading

<<<---lending money so people can gamble in the stock market

the Fed has been lying about this and was outed by a BIS paper, it really is $4.5 TRILLION

Anonymous

(ID: cVhqXaNB)

9/5/2025, 1:52:34 PM

No.514866836

[Report]

9/5/2025, 1:52:34 PM

No.514866836

[Report]

>>514866762

>the NYFed primary dealers have been lying about this and were outed by a BIS paper, it really is $4.5 TRILLION

Anonymous

(ID: i0cn4BKW)

9/5/2025, 1:57:49 PM

No.514867111

[Report]

>>514867400

9/5/2025, 1:57:49 PM

No.514867111

[Report]

>>514867400

Hello, I have been devising a new theory of money, and have come up with a new revelation.

1. Money is an article of faith. I give you my prized cow, you give me money. What makes some little papers worth a cow? Faith that they will be elsewhere redeemable. Money is faith. I go to work, I slave for 12 hours a day, for some slips of paper. I have faith that they will buy stuff.

2. The continuously dwindling value of our money reduces faith in that money. As the money loses value, so too does the people lose faith in that money. The current project seems to want to keep dwindling the value of money forever, which means faith in money will keep dwindling forever.

3. As people lose faith in money, they will cease to participate in monetary transactions, such as working for money or selling for money, and strive to detach themselves from the system of money as much as possible.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 1:59:24 PM

No.514867212

[Report]

>>514867408

>>514875253

9/5/2025, 1:59:24 PM

No.514867212

[Report]

>>514867408

>>514875253

A reminder, Federal Reserve Notes are what are being issued to worthless oblivion and

>the US dollar is a fucking UNIT

We need to AGAIN issue debt-free, Treasury-issued US Notes like we did before (and during) the bloodsucking, obsolete Federal Reserve. We need to AGAIN issue debt-free US Notes that are pegged to a basket of commonly-used weighted commodities, distributed by a series of state banks.

We can:

1 nationalize Fed banks

OR

2 dissolve Fed and have a series of state banks

OR

3 issue US Notes simultaneously AGAIN and eventually recycle worthless Federal Reserve Notes out of circulation

OR

4 YOU CAN RIGHT NOW: use cash/barter/stack/use credit unions/use cold wallets, these five things IMMEDIATELY transfer power directly to the people

USE CASH, NO MATTER WHAT COUNTRY YOU ARE IN, cash IMMEDIATELY puts the power in the hands of the people.

Real paper cash:

>is permissionless

>is private

>is anonymous

>has no transaction fees

>works in power outages

>doesn’t need the internet

>don't need to be a coder to use it

>doesn't depend on another party having a device

>everyone knows exactly how much they have

>has no transaction limits or thresholds for reporting

>money laundering is harder with physical cash, due to transport

>is inclusive, it does not see race

>is harder to use in ransoms

>can’t be hacked

>don’t need to remember a password to use it

>IS the ultimate in payment platforms

>using cash helps people to save money and budget

>puts the power directly in the hands of the people

>keeps the currency near the REAL goods and services

>less paperwork

>is face to face, not face to screen

>makes government theft harder

>using cash forces the debt-based Federal Reserve to serve the citizens

Boycott businesses that do not take cash.

NEVER USE YOUR PHONE TO PAY.

Barter is the real torpedo to these fucking clowns.

update pic rel to $241 B

Anonymous

(ID: N7oCx/oe)

9/5/2025, 2:00:44 PM

No.514867291

[Report]

9/5/2025, 2:00:44 PM

No.514867291

[Report]

>>514866762

Out of control retail margin spending is what caused the liquidity crunch during the great depression. Every day people could no longer spend. Hedge fund losing their unicorn money might crimp investment spending but it would have little do w th consumer spending.... unless another nigger in the white house decides to give them $3T to make them whole again--then say hello to inflation again.

Stop being a retarded faggot.

Anonymous

(ID: N7oCx/oe)

9/5/2025, 2:02:52 PM

No.514867400

[Report]

>>514867680

9/5/2025, 2:02:52 PM

No.514867400

[Report]

>>514867680

>>514867111

1901 called and wants its economic policy back.

Money is a debt facility now. You can't incur or service debt without it. Given everyone is so fucking hooked on debt, money isn't going anywhere.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:03:05 PM

No.514867408

[Report]

>>514875253

9/5/2025, 2:03:05 PM

No.514867408

[Report]

>>514875253

>>514867212

<<<---update pic rel to $241 B

only atlanta and St. louis Fed franchises came back above water (this is ironic b/c these regional Fed franchises have many banks and little capital, so this may go to show that where money is more dispersed among the people, it is more stable)

Anonymous

(ID: c1kZ8Ekr)

9/5/2025, 2:04:41 PM

No.514867504

[Report]

9/5/2025, 2:04:41 PM

No.514867504

[Report]

>>514864812

Under trump your faggot ass can do that

Anonymous

(ID: i0cn4BKW)

9/5/2025, 2:07:53 PM

No.514867680

[Report]

>>514867818

>>514867837

9/5/2025, 2:07:53 PM

No.514867680

[Report]

>>514867818

>>514867837

>>514867400

Money is not a debt facility for most people. For most people money is a reward earned by their labor, which they use to buy their needs and wants. I am trying to explain to the fiat bankers why a stable currency is important. I believe that continuously weakening a currency will create a psychological black hole in the general population. Where once they had faith in the currency, now they lose faith every time the currency loses value. This disincentivizes working for money, selling for money, and saving up money. The endgame is everyone trying to get away from the infinitely depreciating asset as much as possible. Money has become a hot potato no one wants to have. This directly disincentivizes any sort of commercial, industrial, wealth generating activities.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:08:49 PM

No.514867736

[Report]

>>514867876

>>514890892

9/5/2025, 2:08:49 PM

No.514867736

[Report]

>>514867876

>>514890892

Money is often falsely equated with productivity, intelligence, class, success, integrity, and/or good taste.

If you equate success with money, you will likely be perpetually dissatisfied, in a constant state of longing.

But if you VALUE THINGS WHICH CANNOT BE BOUGHT, such as:

community

family

work ethic

intellect

fitness

perseverance

cleanliness

honesty

integrity

compassion

tradition

loyalty

reliability

patience

humor

If you value the above, you will always be content and successful, no matter where you are or what you do.

Judge yourself by deed, not possession.

Money does not make food.

Labor, Seeds, Land, Air, Sun, and Water make food— we have ALL of these things WITHOUT fucking money. If you remove JUST ONE of these items, YOU WILL NOT HAVE FUCKING FOOD.

MONEY DOES NOTHING BUT ACT AS A QUANTIFIER FOR FUCKING TRADE.

We cannot have unearned income AT THE EXPENSE OF earned income. Finance must be the servant of production, not its master.

picrel the Federal Reserve Notes that US Taxpayers paid to borrow their own fucking currency

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:10:12 PM

No.514867818

[Report]

>>514868093

9/5/2025, 2:10:12 PM

No.514867818

[Report]

>>514868093

>>514867680

>to the fiat bankers

'fiat' isn't the problem

WHO IS ISSUING the 'fiat' IS THE PROBLEM and that the Fed's private fiat IS INTEREST-BEARING is the fucking problem

FIAT, CREDIT-BASED INTEREST-FREE US NOTES ISSUED BY THE US TREASURY WORK FOR THE PEOPLE AND ARE INTENDED TO BE AN INTEREST-FREE TOOL TO FACILITATE COMMERCE

FIAT, DEBT-BASED, USURIOUS, INTEREST-BEARING FEDERAL RESERVE NOTES ARE FUCKING BORROWED FROM THE PRIVATELY-INCORPORATED NY FEDERAL RESERVE FRANCHISE AND ONLY ENRICH THE NYFED’S PRIMARY DEALERS AND THEIR CRONY/POLITICAL ILK AND ENSLAVE THE POPULATION IN BOND DEBT

Fiat is given value BY A NATION'S CITIZENS.

If the nation's treasury is the one issuing it, fiat is not a problem.

Anonymous

(ID: N7oCx/oe)

9/5/2025, 2:10:31 PM

No.514867837

[Report]

>>514867934

9/5/2025, 2:10:31 PM

No.514867837

[Report]

>>514867934

>>514867680

Who the fuck doesn't have debt?

Anonymous

(ID: Hcf5GHEK)

9/5/2025, 2:11:02 PM

No.514867866

[Report]

9/5/2025, 2:11:02 PM

No.514867866

[Report]

>>514865468

>wages are soaring

It's impossible for (real) wages to ever reach the level they were in 1970.

Inflation, mass immigration, and off-shoring of industries has conspired to keep the average american's labor the dame price for 5 decades.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:11:14 PM

No.514867876

[Report]

>>514868353

9/5/2025, 2:11:14 PM

No.514867876

[Report]

>>514868353

>>514867736

>Money does not make food.

>Labor, Seeds, Land, Air, Sun, and Water make food— we have ALL of these things WITHOUT fucking money. If you remove JUST ONE of these items, YOU WILL NOT HAVE FUCKING FOOD.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:12:25 PM

No.514867934

[Report]

>>514869134

9/5/2025, 2:12:25 PM

No.514867934

[Report]

>>514869134

>>514867837

well.... lol

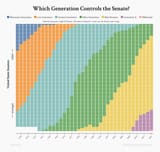

note how the 1%ile line and the 2-10%ile line mirror each other

>>514867818

Listen mate we are on the same side but were talking about a system which 99% of people misunderstand and yelling in caps doesn't make it more easily understood.

I think there is a general class of bankers, several million financiers throughout the West, and I dont think they understand how badly the infinite depreciation of currency affects mass perception of currency. In effect this system has inverted the social ladder. The man who spent his whole life earning and saving money is now seen as a fool, because money is an infinitely depreciating asset. This obviously will result in a general deindustrialization and demonetization of the economy. And you look around the streets and the moral values of society are reflecting that. Rich men and hard workers are seen as tools, while criminals are seen as power players. This system will result in the total disempowerment of the professional, financial classes by the people who operate outside of the money system.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:16:22 PM

No.514868158

[Report]

>>514868544

9/5/2025, 2:16:22 PM

No.514868158

[Report]

>>514868544

the people already have the power to stop any tyranny by SIMPLY USING CASH AND LEAVING YOUR PHONE AT HOME sometimes

these two simple things destroy any surveillance plans

you already have the fucking power

it is YOU that chooses to continue using the grid to your own detriment

you already have the power right now

you have agency still

they just need your consent to implement it wholly, then having agency won't even matter

the current tech trend is for citizens to not hold or own information or organize it or remember it

they also do not store it on their own computers, but in a foreign cloud that tracks all changes in real time

they only have instantaneous ACCESS to information

people are not being conditioned to retain info or organize it for themselves

tptb are now waiting for anyone with a high amount of intellect and knowledge to die off, then they will just be left with the malleable, dumbed-down 'instantaneous access' population that can't put two and two together

USE FUCKING CASH AS MUCH AS POSSIBLE NO MATTER WHAT COUNTRY YOU ARE IN

NEVER USE YOUR PHONE TO PAY

A NATION'S FIAT IS THE POWER OF THE PEOPLE IN THEIR OWN FUCKING HANDS

and this is why the Fed seeks to even abolish paper Federal Reserve Notes (as seen in this image

>>514866127), b/c fiat paper mostly SERVES THE FUCKING CITIZEN:

fiat is the common national bond and cooperation of the value of one's labor

if this fiat is issued by a private, debt-based central bank, then only the central bank profits from the labor of the citizens, not the national treasury or the citizens

Anonymous

(ID: /QbTPzyY)

9/5/2025, 2:16:36 PM

No.514868172

[Report]

>>514868520

9/5/2025, 2:16:36 PM

No.514868172

[Report]

>>514868520

>>514864246 (OP)

By this logic 2008 Zimbabwe was the greatest economy in recorded history. Across nearly every metric we are worse off than during the great depression, yet we are being expected to believe that we are actually doing well.

Anonymous

(ID: u3Bjn+dL)

9/5/2025, 2:18:43 PM

No.514868288

[Report]

9/5/2025, 2:18:43 PM

No.514868288

[Report]

>>514864246 (OP)

Because "the economy" can be measured different ways. By measuring it in stock value, you're measuring it in profit by certain companies and that's good if you happen to have stock in that company, but even that value to you is limited because that profit you may have been able to build to earn an early retirement may be at your own expense if you happen to work for that company and depend on the product; the price of your shares have skyrocketed, but it's after your company laid off your department and made their products more expensive. One may look at the stock and say the economy is doing great while ignoring the negative impact on workers and consumers.

Anonymous

(ID: g0UGeCbu)

9/5/2025, 2:19:50 PM

No.514868353

[Report]

>>514868656

9/5/2025, 2:19:50 PM

No.514868353

[Report]

>>514868656

>>514867876

globalism fixed it. you no longer need to produce anything only need to produce money

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:20:38 PM

No.514868400

[Report]

>>514868648

>>514893174

9/5/2025, 2:20:38 PM

No.514868400

[Report]

>>514868648

>>514893174

>>514868093

>saving money

the very fucking act of hoarding currency devalues it

hurrrrrrrrrrrrr

the reason it is called currency is BECAUSE IT IS SUPPOSED TO BE FUCKING MOVING THROUGHOUT THE ECONOMY

First:

US Gold Notes and US Silver Notes are interest-free, metals-backed, NON-fiat notes that could be issued by the US Treasury TODAY.

US Notes are interest-free, fiat notes that could be issued by the US Treasury TODAY, they can also be metals-backed and were intended to be used as a tool for the citizens to trade.

Federal Reserve Notes are DEBT-BASED, fiat notes issued out of thin air by the privately-incorporated, now-BANKRUPT Federal Reserve 12 regional franchises and are currently bankrupting the US Treasury.

All of the above are ALL DENOMINATED IN US DOLLARS (aka $US), which is a fucking UNIT.

And secondly, there are FOUR ways currency is created in the US:

1 Congressionally-approved Public Issues treasuries for deficit spending via the issuance of marketable US treasuries sold by the NYFed’s primary dealers aka Debt Held by the Public (now ~$35 T)

2 Intragovernmental Debt GAS securities (aka ‘Unfunded Liabilities’) that are created/issued for currency to run public agencies (over $152 T now) and ARE PURCHASED WITH YOUR PAYROLL TAXES

3 The commercial tier 2 depository banking sector, it makes small loans in which only the interest remains in the banking system after the loan is paid back (the principal and repayments are destroyed when the loan is repaid) —this can remain when the Fed is dissolved

4 QE, this is fucking counterfeiting by the now-insolvent NYFed's primary dealers since 2008 via IOER (now called IORB) and we pay all sorts of interest on this, increasing every day with raising rates

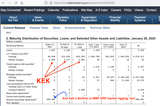

pic rel

trillions in vacant underwater CRE held by primary dealers, yet rent nor house prices ever decrease

>what is extend and pretend policy?

lol

Anonymous

(ID: vPsgFZlT)

9/5/2025, 2:22:40 PM

No.514868520

[Report]

9/5/2025, 2:22:40 PM

No.514868520

[Report]

>>514868172

The rich are doing great while the middle class and poor are screwed

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:23:02 PM

No.514868544

[Report]

>>514875253

9/5/2025, 2:23:02 PM

No.514868544

[Report]

>>514875253

>>514868158

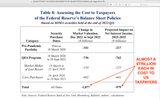

>this is why the Fed seeks to even abolish paper Federal Reserve Notes (as seen in this image >>514866127 (You)), b/c fiat paper mostly SERVES THE FUCKING CITIZEN:

notice on the top half of pic rel the NYFed squeezes out the citizens' currency and pays its ilk instead, while also buying houses and bonds

it clearly prioritizes enriching its private owner banks over the citizens having a currency

why doesn't trump ever mention this?

b/c fucking trump thinks the Fed is the house

the FUCKING US TAXPAYER IS THE FUCKING HOUSE

Anonymous

(ID: TdDLUzf+)

9/5/2025, 2:24:04 PM

No.514868588

[Report]

9/5/2025, 2:24:04 PM

No.514868588

[Report]

>>514864246 (OP)

Your "good economy" is just corporations cannibalizing themselves to juice their share prices with stock buybacks.

Anonymous

(ID: i0cn4BKW)

9/5/2025, 2:25:07 PM

No.514868648

[Report]

>>514868714

>>514868797

9/5/2025, 2:25:07 PM

No.514868648

[Report]

>>514868714

>>514868797

>>514868400

The point of currency is to measure value. If someone wants to store their currency, who are you to force them to do otherwise? What if they want to save up for a local hurricane relief fund or a communal pool to fix a local road or build a local industrial project? What you are proposing is that people be disincentivized from saving money. Doesn't that sound silly? What if there is a catastrophe or they want to save up for something big or maybe they just want to leave something for their children? By making it impossible to save money, you create a state where everyone is poor, all the time.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:25:21 PM

No.514868656

[Report]

9/5/2025, 2:25:21 PM

No.514868656

[Report]

>>514868353

they have replaced actual success with money and are purchasing assets

Anonymous

(ID: HOsGVP/i)

9/5/2025, 2:25:25 PM

No.514868659

[Report]

9/5/2025, 2:25:25 PM

No.514868659

[Report]

>>514864246 (OP)

It's all from a speculative bubble in the tech industry that AI is going to revolutionize the economy, which is not going to happen soon.

Anonymous

(ID: liimx2rP)

9/5/2025, 2:25:35 PM

No.514868672

[Report]

>>514887059

9/5/2025, 2:25:35 PM

No.514868672

[Report]

>>514887059

>>514865468

>Not an American

>Rising cost of living and inflation is not a problem because muh S&P500 is up

No one asked for your opinion, Jagmeet

Anonymous

(ID: afwzsZeT)

9/5/2025, 2:25:50 PM

No.514868691

[Report]

9/5/2025, 2:25:50 PM

No.514868691

[Report]

>>514864246 (OP)

Most americans dont make their living off the stock market

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:26:07 PM

No.514868714

[Report]

9/5/2025, 2:26:07 PM

No.514868714

[Report]

>>514868648

>point of currency is

to quantify cooperation, value, national unity...

none of which the Fed are doing lol

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:27:50 PM

No.514868797

[Report]

>>514868951

9/5/2025, 2:27:50 PM

No.514868797

[Report]

>>514868951

>>514868648

there should be a limit on hoarding currency and then it should have to be converted to real assets

money can be backed by labor as it is now or it can be backed by commodities, metals, the possibilities are fucking endless

Anonymous

(ID: i0cn4BKW)

9/5/2025, 2:30:33 PM

No.514868951

[Report]

>>514869215

>>514869410

9/5/2025, 2:30:33 PM

No.514868951

[Report]

>>514869215

>>514869410

>>514868797

There have been millions of boomers "hoarding" (saving) money since they started working in the 1960s and the earnings they made back then are worth almost nothing today due to inflation. The effect this has on mass psychology is to suggest that working and saving are useless. That destroys capitalism.

Anonymous

(ID: N7oCx/oe)

9/5/2025, 2:33:33 PM

No.514869134

[Report]

9/5/2025, 2:33:33 PM

No.514869134

[Report]

>>514867934

Doesn't answer the question. Who doesn't have debt?

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:35:09 PM

No.514869215

[Report]

9/5/2025, 2:35:09 PM

No.514869215

[Report]

>>514868951

>There have been millions of boomers "hoarding" (saving) money since they started working in the 1960s

it's way worse than you think lel

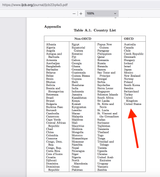

<<<<—The red arrow is the running tally just for the US Intragovernmental Debt. These ‘unfunded liabilities’ include Medicare (~70% of picrel) and Social Security (~25%) and Disability (~5%).

$152 TRILLION (US taxpayers paid $237 Billion in interest on this Intragovernmental Debt in FY 2024 ALONE). This is the amount that is owed out, as of today, based on what was taken in, in (mostly) payroll taxes.

THIS DOES NOT INCLUDE the ~$36 TRILLION in Marketable Debt (aka Public Issues) that the public is always bitching about (US taxpayers paid $896 B in interest on this in FY 2024 ALONE).

So, the running tally for US currency ‘borrowed’ from the NOW-INSOLVENT private Federal Reserve's debt franchise is ~$187 Trillion.

$187 fucking TRILLION.

https://fiscaldata.treasury.gov/datasets/interest-expense-debt-outstanding/interest-expense-on-the-public-debt-outstanding#data-table

Anonymous

(ID: F6OJ5Jvc)

9/5/2025, 2:36:20 PM

No.514869270

[Report]

9/5/2025, 2:36:20 PM

No.514869270

[Report]

5 years ago

Net worth -15000

Today

Net worth

200k

It gets better bros

Anonymous

(ID: YHEd1xJl)

9/5/2025, 2:36:30 PM

No.514869281

[Report]

9/5/2025, 2:36:30 PM

No.514869281

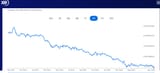

[Report]

more like down jones

Anonymous

(ID: xMmm5VuR)

9/5/2025, 2:37:16 PM

No.514869318

[Report]

9/5/2025, 2:37:16 PM

No.514869318

[Report]

>>514864246 (OP)

99% of americans hold zero stocks

Anonymous

(ID: ccVW2Phc)

9/5/2025, 2:37:29 PM

No.514869332

[Report]

>>514869569

>>514864246 (OP)

I dunno shit about the econ but someone said that the econ is fine but the inflation rates are fucking awful, and thats pretty much the extent of my knowledge so far about this kinda stuff. I hope a nice business learned anon can explain in more detail.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:38:57 PM

No.514869410

[Report]

9/5/2025, 2:38:57 PM

No.514869410

[Report]

>>514868951

the boomers have a ponzi scheme

it really is that simple

spme pertinent pasta:

Credit-based fiat, interest-free US Notes issued by the US Treasury for the citizens to use for daily commerce are VERY DIFFERENT from debt-based, borrowed, private, interest-bearing Federal Reserve Notes issued by the bloodsucking BANKRUPT NYFed, which are then also used to primarily reinvest back into the NYFed’s securities casino.

‘Investing’ is just people further bankrupting the US by putting the NYFed’s private Federal Reserve Notes back into their debt-based system via the treasury market.

the legislative volley between boomers and billionaires that leaves everyone out:

NYFed owners say they need more taxes from social security/medicare payments to pay them interest

boomers say big bank fleecing of the country is fine as long as they're getting social security

and they both continue to make laws (PICREL) to protect their positions, so now, effectively all wealth is going to the old and dying

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:40:52 PM

No.514869513

[Report]

9/5/2025, 2:40:52 PM

No.514869513

[Report]

first world and third world are about to become second world

i call this the great evening

>lazy skimmers dread real price discovery

we are going to nationalize the bankrupt fed

Anonymous

(ID: NPkGAJGO)

9/5/2025, 2:41:51 PM

No.514869569

[Report]

9/5/2025, 2:41:51 PM

No.514869569

[Report]

>>514869332

>inflation: 3%

>market: +10%

Hmm we should impeach drmpf…

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:42:26 PM

No.514869614

[Report]

>>514869869

9/5/2025, 2:42:26 PM

No.514869614

[Report]

>>514869869

now the Federal Reserve franchises have their dream come true, note the right side of the chart, high reserves and high IORB

the last time they tried to have both, JPM got raided by the FBI for rigging treasury and silver markets which caused the repo spike, all big banks failed again quietly, they got bailed out again for trillions in 2019 and then we had covid, which shut down the economy and conveniently hid their illiquidity lol

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:44:43 PM

No.514869734

[Report]

>>514870200

9/5/2025, 2:44:43 PM

No.514869734

[Report]

>>514870200

the US hasn't been the reserve currency for a long time

40% euro is also daily usage

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:47:14 PM

No.514869869

[Report]

9/5/2025, 2:47:14 PM

No.514869869

[Report]

>>514869614

>all big banks failed again quietly, they got bailed out again for trillions in 2019

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:48:48 PM

No.514869949

[Report]

>>514870166

9/5/2025, 2:48:48 PM

No.514869949

[Report]

>>514870166

<<<---lol

US credit unions and community banks (which are regulated outside the Fed and insured by their own pool) are the real economic engines of the local economies and are greater in number (5,000, not counting branches) than bank holding companies under the Fed (4,000 and getting fucking smaller every day as the NYFed’s primary dealers acquire the other bank holding companies and regional banks pic related kek)

If the Federal Reserve Note does crash, Americans can then move to the credit unions, community banks, etc, and we can then issue debt-free US Notes again for commerce, as they were intended to be. These credit unions and community banks also don't hold all the shit MBS and CRE debt, they are much more solvent.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:49:50 PM

No.514870000

[Report]

>>514872789

9/5/2025, 2:49:50 PM

No.514870000

[Report]

>>514872789

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:52:44 PM

No.514870166

[Report]

>>514870220

9/5/2025, 2:52:44 PM

No.514870166

[Report]

>>514870220

>>514869949

>These credit unions and community banks also don't hold all the shit MBS and CRE debt, they are much more solvent.

lel pic related shows the banks will extend credit to the worst if it suits them

this is the 2008 failures on steroids

the Nyfed has $10T in IOUs and $12B in operating capital

Anonymous

(ID: N7oCx/oe)

9/5/2025, 2:53:13 PM

No.514870200

[Report]

>>514870347

9/5/2025, 2:53:13 PM

No.514870200

[Report]

>>514870347

>>514869734

That's not a reserve currency.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:53:34 PM

No.514870220

[Report]

9/5/2025, 2:53:34 PM

No.514870220

[Report]

>>514870166

>lel pic related shows the banks will extend credit to the worst if it suits them

>this is the 2008 failures on steroids

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:55:47 PM

No.514870347

[Report]

>>514870457

>>514870667

9/5/2025, 2:55:47 PM

No.514870347

[Report]

>>514870457

>>514870667

>>514870200

it means that transactions are increasingly using all sorts of currencies----- most likely their own (which is known as Original Sin amongst central bankers)---- nations are not just using the Federal Reserve Note

Anonymous

(ID: cVhqXaNB)

9/5/2025, 2:57:39 PM

No.514870457

[Report]

9/5/2025, 2:57:39 PM

No.514870457

[Report]

>>514870347

the BIS wants a country to be unable to borrow in its own currency

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:00:56 PM

No.514870640

[Report]

9/5/2025, 3:00:56 PM

No.514870640

[Report]

zambia gets it

Anonymous

(ID: N7oCx/oe)

9/5/2025, 3:01:20 PM

No.514870667

[Report]

>>514870824

9/5/2025, 3:01:20 PM

No.514870667

[Report]

>>514870824

>>514870347

Groan. That's still not what a "reserve" currency is.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:04:03 PM

No.514870824

[Report]

>>514871200

>>514875896

9/5/2025, 3:04:03 PM

No.514870824

[Report]

>>514871200

>>514875896

>>514870667

i know what a reserve currency is

please do enlighten me if I am incorrect

i'll wait

pic related is how global finance is all working together behind the scenes right now while the politicians pretend to be at war

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:05:07 PM

No.514870894

[Report]

9/5/2025, 3:05:07 PM

No.514870894

[Report]

it's raining here

i can go all fucking day

Anonymous

(ID: GsApDTwA)

9/5/2025, 3:06:44 PM

No.514870996

[Report]

>>514871051

>>514871777

9/5/2025, 3:06:44 PM

No.514870996

[Report]

>>514871051

>>514871777

>>514864246 (OP)

All growth is from 10 companies or so, and all on the basis of the AI grift. It’s the last bubble and when it pops it’s taking everything else down with it. There are no other bullish narratives

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:06:53 PM

No.514871003

[Report]

9/5/2025, 3:06:53 PM

No.514871003

[Report]

op 2pbtid slide thread

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:07:38 PM

No.514871051

[Report]

9/5/2025, 3:07:38 PM

No.514871051

[Report]

>>514870996

>all on the basis of the AI grift.

lol

Anonymous

(ID: bJPo4jVT)

9/5/2025, 3:10:09 PM

No.514871182

[Report]

9/5/2025, 3:10:09 PM

No.514871182

[Report]

>>514864246 (OP)

The stock market is not a good representation of the actual economy, which has been increasingly dogshit over the years.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:10:27 PM

No.514871200

[Report]

9/5/2025, 3:10:27 PM

No.514871200

[Report]

>>514870824

>pic related is how global finance is all working together behind the scenes right now while the politicians pretend to be at war

pic rel too

buying up every fintech in sight

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:11:16 PM

No.514871244

[Report]

9/5/2025, 3:11:16 PM

No.514871244

[Report]

lol

ok i'll stop

Anonymous

(ID: O6Zf4/eK)

9/5/2025, 3:13:18 PM

No.514871358

[Report]

9/5/2025, 3:13:18 PM

No.514871358

[Report]

>>514865331

>A cheeseburger is $10 and a new truck is $100,000. You call that ideal?

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:20:37 PM

No.514871777

[Report]

>>514871901

9/5/2025, 3:20:37 PM

No.514871777

[Report]

>>514871901

>>514870996

>the AI grift.

lol

Anonymous

(ID: GsApDTwA)

9/5/2025, 3:23:03 PM

No.514871901

[Report]

9/5/2025, 3:23:03 PM

No.514871901

[Report]

>>514871777

Yes, this is a good example of the grift. Also checked

Anonymous

(ID: aaVN2o3Q)

9/5/2025, 3:25:21 PM

No.514872013

[Report]

9/5/2025, 3:25:21 PM

No.514872013

[Report]

>>514864246 (OP)

stocks are only going up because the dollar is getting more and more worthless. the only people benefitting are the rich, because they own most of the stocks anyways.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:25:52 PM

No.514872051

[Report]

>>514872131

9/5/2025, 3:25:52 PM

No.514872051

[Report]

>>514872131

<<<----palantir and trump using this for all sorts of things

pic rel is from the palantir's people-tracking app contract with the US govt

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:27:26 PM

No.514872131

[Report]

9/5/2025, 3:27:26 PM

No.514872131

[Report]

>>514872051

and this is why the govt says it can ONLY hire palantir

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:29:25 PM

No.514872240

[Report]

9/5/2025, 3:29:25 PM

No.514872240

[Report]

https://archive.4plebs.org/pol/thread/505237484/

^^^ A thread about the NYFed and its ilk now trying to convince the boomers to switch from private Federal Reserve-issued, debt-based Federal Reserve Notes to privately-issued, debt-backed stablecoin tokens. This is going to be priceless to watch. Neither of these currency options benefit the citizens, they only benefit the private issuer. Will boomers sell out once again to the banks to save themselves from a failing system that they created? One last fuck you to the country as they insulate themselves in their private tokens?

And in the next orchestrated crisis, are the boomers’ new asset tokens to become worthless, as the payment platform is the ultimate claimant to any reserve assets in a crisis or bankruptcy?

When is the currency going to be restored to the people? Don't US taxpayers have a right to a debt-free currency issued by their own treasury?

Pic related was just passed.

This is just entitled boomer classists driving the fucking country into the ground for money (mostly from the now-bankrupt NYFed's QE policies) and now destroying the US taxpayer's currency (the fucking US$, which is A FUCKING UNIT) on the world stage with the Fed’s issued-into-oblivion, worthless Federal Reserve Note.

How fraudulent do you have to be that you can actually destroy a fucking unit of measurement? lol holy fuck

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:36:46 PM

No.514872666

[Report]

9/5/2025, 3:36:46 PM

No.514872666

[Report]

tick tock

Anonymous

(ID: NDh8J0BT)

9/5/2025, 3:38:36 PM

No.514872789

[Report]

>>514873044

9/5/2025, 3:38:36 PM

No.514872789

[Report]

>>514873044

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:41:10 PM

No.514872957

[Report]

>>514873085

>>514873295

9/5/2025, 3:41:10 PM

No.514872957

[Report]

>>514873085

>>514873295

a lot going on

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:42:24 PM

No.514873044

[Report]

9/5/2025, 3:42:24 PM

No.514873044

[Report]

>>514872789

or embrace pic rel

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:43:03 PM

No.514873085

[Report]

9/5/2025, 3:43:03 PM

No.514873085

[Report]

>>514872957

and this, too! at such a time

Anonymous

(ID: F/TC6aAx)

9/5/2025, 3:43:44 PM

No.514873126

[Report]

9/5/2025, 3:43:44 PM

No.514873126

[Report]

>>514864246 (OP)

>Why do Americans keep complaining about the economy when the stock market is hitting all-time highs? Literally just log into your investment accounts and check your balance - you're doing great. Why is there so much whining during what are very close to ideal economic conditions?

its called a bubble i.e. 1989, 2001, 2008 etc

they come like clockwork, its just boom, bust, fleece the rubes, rinse repeat, rich get richer, poor get poorer every cycle

in 2008 the rich got bailed out and the poor got foreclosed and bankrupted, in the largest wealth transfer from the poor to the rich, up till now

Tesla is the poster baby for this everything-bubble

Anonymous

(ID: hUQOEJnI)

9/5/2025, 3:44:15 PM

No.514873156

[Report]

>>514874181

9/5/2025, 3:44:15 PM

No.514873156

[Report]

>>514874181

>>514864246 (OP)

I don’t think most Americans even know how to invest cocksucker they should teach It in high school it’s so fundamental to the American grift (dream)

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:46:16 PM

No.514873295

[Report]

9/5/2025, 3:46:16 PM

No.514873295

[Report]

>>514872957

is this a way of saying the people of colombia will be protected by the us govt from the cartel only if they allow themselves to be entrenched in bond debt?

cuase that's how it looks to me

Anonymous

(ID: 6EcufI4G)

9/5/2025, 3:49:20 PM

No.514873496

[Report]

>>514873816

9/5/2025, 3:49:20 PM

No.514873496

[Report]

>>514873816

>>514864246 (OP)

Because funny-money I can't do anything with gor 30-40 years doesn't mean as much to me as the money in my pocket now and the money in my pocket now can buy jack shit compared to what it could do five years ago.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 3:53:53 PM

No.514873816

[Report]

>>514874639

9/5/2025, 3:53:53 PM

No.514873816

[Report]

>>514874639

>>514873496

>funny-money I can't do anything with gor 30-40 years

aaaaaaaand there goes the fucking currency

it's like ruining a neighborhood, but in devaluation rather than blight

debt-based currencies are doomed to fail as the $241 BILLION IN THE HOLE-INSOLVENT Federal Reserve is failing now

Anonymous

(ID: F/TC6aAx)

9/5/2025, 3:58:59 PM

No.514874181

[Report]

9/5/2025, 3:58:59 PM

No.514874181

[Report]

>>514873156

>I don’t think most Americans even know how to invest cocksucker they should teach It in high school it’s so fundamental to the American grift (dream)

high school has a hard enough time teaching kids to read

but there should be a capitalism101 shop class in high school where you get to play invest

along with police-law101 and credit-card101 and home-buying-renting101 and marriage-divorce101 and health-care-nutrition101 classes

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:01:22 PM

No.514874332

[Report]

>>514874399

>>514874568

9/5/2025, 4:01:22 PM

No.514874332

[Report]

>>514874399

>>514874568

The debt-based Federal Reserve (the Fed) and the IRS were both created in 1913.

The new IRS conveniently forced everyone to use their new Federal Reserve Notes to pay their new US Federal Income Tax.

The Fed was supposed to stabilize the US currency by backing every Federal Reserve Note (FRN) issued (TO BUY US TREASURIES) with 40% gold (40 cents of gold for each $1 FRN issued).

In 1933, everyone’s gold was confiscated by the Treasury (except $100 worth/person) b/c the Fed convinced US Pres FDR that Americans were hoarding gold & they were forced to trade their gold in for $20.67/troy oz. Federal Reserve Notes were also now no longer exchangeable for gold.

In 1934 the Gold Reserve Act allowed FDR to establish the gold value of the dollar solely by proclamation & raised the exchange rate to $35/oz troy, extracting wealth & value once again from the American public.

In 1944, the IMF & the International Bank for Reconstruction and Development (IBRD) were formed at the Bretton Woods Conference.

In 1958, Bretton Woods pegs all foreign currencies to the dollar, & the dollar pegged to gold at $35/troy oz. Debt-based Central Banks under the BIS pop up all over the world to facilitate the Fed & the BoE in their check kiting, fractional reserve, debt-based central-banking ponzi.

In 1971, Nixon depegs the dollar to gold entirely, making the US currency free-floating fiat, which completely negated the original Federal Reserve Act of 1913, which was to back each Federal Reserve Note issued with gold.

In 1974, Pres Ford legalizes gold ownership again without limitation & gold is NOW valued at $42/ozt.

The NOW BANKRUPT Federal Reserve & its biggest shareholders, the NYFed’s primary dealers, for the last 50 years & up to today, continue to issue our currency out of thin air, while charging us interest to do so. Rewarding insolvent, failing banks & investment firms using QE and taxpayer money over & over again, acquiring assets during crises, while rigging global markets.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:02:14 PM

No.514874399

[Report]

9/5/2025, 4:02:14 PM

No.514874399

[Report]

>>514874332

>The Fed was supposed to stabilize the US currency by backing every Federal Reserve Note (FRN) issued (TO BUY US TREASURIES) with 40% gold (40 cents of gold for each $1 FRN issued).

lol note the dollar IS A UNIT

>>514874332

>The NOW BANKRUPT Federal Reserve

you are confused about the FED, the only way for the FED to go bankrupt is a military defeat of the US military

The Federal Reserve (the Fed) cannot go bankrupt in the traditional sense like a private entity. It’s a unique institution with the ability to create money and manage the U.S. monetary system, which fundamentally alters the concept of bankruptcy for it. Here's a concise breakdown:

Money Creation: The Fed can issue U.S. dollars, as it controls the money supply. If it faces financial shortfalls, it can theoretically create more money to cover obligations, making insolvency in a conventional sense impossible.

Structure and Backing: The Fed operates as a central bank, backed by the U.S. government and its ability to tax. Its balance sheet includes assets like U.S. Treasury securities and liabilities like currency in circulation. Even if its liabilities exceed assets, it can continue operations due to its monetary authority.

Operational Independence: The Fed earns income from interest on its asset holdings (e.g., bonds). While it can technically run a deficit (as seen in 2022–2023 when interest payments on reserves outpaced income), it records these as "deferred assets" and continues functioning without needing a bailout.

Hypothetical Risks: Bankruptcy-like scenarios would require extreme conditions, like a complete loss of confidence in the U.S. dollar or government, leading to hyperinflation or systemic collapse. This is more about economic stability than the Fed itself "going bankrupt."

In short, the Fed’s ability to create money and its structural role make traditional bankruptcy impossible, though severe economic crises could challenge its effectiveness.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:05:58 PM

No.514874639

[Report]

9/5/2025, 4:05:58 PM

No.514874639

[Report]

>>514873816

>debt-based currencies are doomed to fail as the $241 BILLION IN THE HOLE-INSOLVENT Federal Reserve is failing now

kek it's really $2t in the hole but the Fed doesn';t use GAAP

lolololoplolol

we are approaching levels of clownworld never thought possible

the real question is how much damage are boomers going to do and will it be irreversible?

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:07:23 PM

No.514874729

[Report]

9/5/2025, 4:07:23 PM

No.514874729

[Report]

>>514874568

the fed is already bankrupt

those that hold the belief that the Fed can hold a negative equity position fully out themselves as Fed supporters

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:08:04 PM

No.514874770

[Report]

9/5/2025, 4:08:04 PM

No.514874770

[Report]

>>514874568

>The Fed can issue U.S. dollars,

no

the fed issues Federal Reserve Notes

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:09:19 PM

No.514874844

[Report]

9/5/2025, 4:09:19 PM

No.514874844

[Report]

>>514874568

>If it faces financial shortfalls, it can theoretically create more money to cover obligations, making insolvency in a conventional sense impossible.

kek

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:15:57 PM

No.514875253

[Report]

>>514875824

9/5/2025, 4:15:57 PM

No.514875253

[Report]

>>514875824

>>514874568

>The Fed earns income from interest on its asset holdings (e.g., bonds).

lol

this is straight off the internet fucking kek

the fed has been bankrupt and not remitted one fucking cent to the treasury since oct 2022

they also will NOT remit one cent to the treasury unitl THEY ARE PAID this ~$241 B

as outlined in:

>>514868544

>>514867408

and

>>514867212

you have no idea what you are talking about

it is so hard to discern between poor AI and genuine stupidity

>like a complete loss of confidence in the Federal Reserve Note

ftfy

pic rel

again:

notice on the top half of pic rel the NYFed squeezes out the citizens' currency and pays its ilk instead, while also buying houses and bonds

it clearly prioritizes enriching its private owner banks over the citizens having a currency

why doesn't trump ever mention this?

b/c fucking trump thinks the Fed is the house

the FUCKING US TAXPAYER IS THE FUCKING HOUSE

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:24:23 PM

No.514875824

[Report]

9/5/2025, 4:24:23 PM

No.514875824

[Report]

>>514875253

>the FUCKING US TAXPAYER IS THE FUCKING HOUSE

<<<----good-natured satire

Anonymous

(ID: N7oCx/oe)

9/5/2025, 4:25:22 PM

No.514875896

[Report]

>>514876332

9/5/2025, 4:25:22 PM

No.514875896

[Report]

>>514876332

>>514870824

A reserve currency is HELD as a backstop to trade swaps. The swaps can be in any currency, though admittedly it is often the dollar. It used to be very important that it was the dollar when were desperate for foreign oil. Those days are over. We dont actually need anything from anyone else, so trade can return to a saner parity like it was for most of our history. This would involve a weaker dollar.

Anonymous

(ID: 2BV4fcZ5)

9/5/2025, 4:29:47 PM

No.514876199

[Report]

9/5/2025, 4:29:47 PM

No.514876199

[Report]

>>514864246 (OP)

Everything is expensive and the dollar is worthless

Anonymous

(ID: /YYzVJV+)

9/5/2025, 4:31:02 PM

No.514876288

[Report]

9/5/2025, 4:31:02 PM

No.514876288

[Report]

>>514864246 (OP)

>economy is good universally because of muh stonks

>the only people actually making money have massive resources to sell their bags to the normie investors

I mean I know you're probably a bot or a tribal political shill, but cmon guy

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:31:50 PM

No.514876332

[Report]

9/5/2025, 4:31:50 PM

No.514876332

[Report]

>>514875896

>so trade can return to a saner parity like it was for most of our history.

debt-based central banks are going to become a thing of the past

currency issued in the form of debt, as we have today, is doomed to fail (as it is now)

once a currency is used as an investment, it is no longer useful as a currency

the treasury market globally will become meaningless

nations will begin to use their own debt-free sovereign currencies issued by their treasuries

the Fed will eventually be dissolved

the US Treasury will issue debt-free US Notes again

Currency backed by labor (productivity and services) makes a nation strong

Currency backed by debt makes a nation slaves

Anonymous

(ID: 62xBJEo/)

9/5/2025, 4:32:48 PM

No.514876403

[Report]

9/5/2025, 4:32:48 PM

No.514876403

[Report]

>>514864246 (OP)

See what you can exit your stocks to. Thats the problem. People are stuck.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:36:28 PM

No.514876644

[Report]

9/5/2025, 4:36:28 PM

No.514876644

[Report]

We issued debt-free US Notes before (and during) the Fed and we will issue them again. The only reason we hired the Fed was to stabilize the currency, because the Fed was going to back the currency with gold (which they reneged on in 1933). NOW THAT THE US CURRENCY IS FIRMLY ESTABLISHED, we can can stop issuing worthless Federal Reserve Notes and again issue debt-free US Notes, like we did before the Fed. Issue our own currency (like an actual sovereign nation) and slowly recycle Federal Reserve Notes out of circulation.

Look at pic related, we issued SIX types of notes SIMULTANEOUSLY for our currency needs. We can issue debt-free US Notes simultaneously with Federal Reserve Notes (only for deficit spending and to be only used in the US). We can then slowly recycle Federal Reserve Notes out of circulation, pay down our debt and not issue any new debt.

The US Dollar will be around long after the Federal Reserve is gone. The world is rejecting the Federal Reserve Note, not the US Dollar. The US Dollar is a UNIT. The US Dollar will ALWAYS exist, it is not fucking ISSUED, it is a unit of measurement.

US NOTES ARE NOT A NOVEL IDEA, THEY JUST DON'T BENEFIT THE FEDERAL RESERVE, WHICH IS WHY US NOTES ARE NEVER MENTIONED DESPITE BEING THE EXACT SOLUTION THAT WE NEED RIGHT FUCKING NOW

and the wiki title was when EACH FEDERAL RESERVE FRANCHISE HAD THEIR OWN NOTES TOO

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:41:04 PM

No.514876931

[Report]

9/5/2025, 4:41:04 PM

No.514876931

[Report]

Anonymous

(ID: H+zPc9UF)

9/5/2025, 4:42:04 PM

No.514877005

[Report]

9/5/2025, 4:42:04 PM

No.514877005

[Report]

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:49:44 PM

No.514877528

[Report]

>>514877697

9/5/2025, 4:49:44 PM

No.514877528

[Report]

>>514877697

The Fed Reserve’s Board of Governors are nominated by the President and confirmed by the Senate. The Fed’s Board of Governors is a neutered and ineffective regulatory body, and under regulatory capture by the NYFed.

The 12 Federal Reserve Regional branches are the public franchisors, public franchisors which sell private franchisee stock to private banks in their region.

The private banks buy stock in their regional Fed franchise, private stock which earns dividends of 6% annually.

The NYFed is the largest and most powerful regional Federal Reserve branch franchise. It conducts all trading for the Federal Reserve and is custodian for its assets. Its biggest shareholders are the private big banks, aka the primary dealers, that issue our currency in the form of bond debt, who are the market makers for these US treasuries and since 2008 have been using those treasuries and QE to counterfeit our currency.

The Fed likes to confuse the publicly-appointed Fed Board of Governors with the privately-incorporated shareholders of the 12 regional Fed franchises, so people don’t realize we are paying private banks to borrow our own currency at interest.

Pic related

Anonymous

(ID: I1xOABF3)

9/5/2025, 4:51:00 PM

No.514877615

[Report]

9/5/2025, 4:51:00 PM

No.514877615

[Report]

>>514864246 (OP)

>just log into your investment account!

American things. You guys are born with stocks. It's not like that elsewhere.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:52:05 PM

No.514877697

[Report]

9/5/2025, 4:52:05 PM

No.514877697

[Report]

>>514877528

>The NYFed is the largest and most powerful regional Federal Reserve branch franchise. It conducts all trading for the Federal Reserve and is custodian for its assets. Its biggest shareholders are the private big banks, aka the primary dealers, that issue our currency in the form of bond debt, who are the market makers for these US treasuries and since 2008 have been using those treasuries and QE to counterfeit our currency.

The NY Fed's Quantitative Easing (QE) counterfeiting scheme:

NYFed buys treasuries (and MBSs) outright from (only) NYFed primary dealers by creating reserves out of thin air, which seditiously undermines Congress’ sole power to regulate our currency. This is QE.

NY Fed’s primary dealers then take those reserves and earn Interest on Excess Reserves aka IOER (now called IORB) on them at the NYFed, interest which IS PAID IN CASH to the primary dealers--cash, which they DO MAKE INTEREST ON, this is their counterfeiting scheme (also, every penny paid in interest (cash) to the primary dealers for excess reserves also reduces the Fed’s remittance to the US Treasury).

The NYFed used QE to bail themselves out during the financial collapse of 2008 and is how its primary dealers have been effectively counterfeiting our currency ever since.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:52:49 PM

No.514877736

[Report]

9/5/2025, 4:52:49 PM

No.514877736

[Report]

fucking kek

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:56:37 PM

No.514878007

[Report]

>>514878109

9/5/2025, 4:56:37 PM

No.514878007

[Report]

>>514878109

<<<<<--------lol

Anonymous

(ID: 9Ts8iu3c)

9/5/2025, 4:58:04 PM

No.514878109

[Report]

>>514878271

9/5/2025, 4:58:04 PM

No.514878109

[Report]

>>514878271

>>514878007

Doing some good work anon, fuck the fed.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 4:58:56 PM

No.514878168

[Report]

9/5/2025, 4:58:56 PM

No.514878168

[Report]

this is fucking bullshit

all of it

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:00:24 PM

No.514878271

[Report]

9/5/2025, 5:00:24 PM

No.514878271

[Report]

>>514878109

just having a rainy day as a construction worker

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:06:06 PM

No.514878688

[Report]

9/5/2025, 5:06:06 PM

No.514878688

[Report]

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:08:32 PM

No.514878871

[Report]

9/5/2025, 5:08:32 PM

No.514878871

[Report]

the fucking Fed NEVER PAID INTEREST NOT EVEN ONCE BEFORE 2008

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:11:11 PM

No.514879073

[Report]

9/5/2025, 5:11:11 PM

No.514879073

[Report]

the Fed pays fucking interest to banks SO THEY WON'T FUCKING LEND IT OUT

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:12:48 PM

No.514879182

[Report]

>>514879270

9/5/2025, 5:12:48 PM

No.514879182

[Report]

>>514879270

A recent thread:

<<<<——-

https://archive.4plebs.org/pol/thread/504503488/

The now-bankrupt Federal Reserve is building a $2.5 B complex in Washington DC and funding it with borrowed US taxpayer money. The Fed is fucking broke and putting Italian beehives in its extravagant rooftop gardens and building private elevators to VIP dining rooms, yet bloviating about the importance of citizens being able to communicate in a republic. lol

To add to the elitism and absurdity, Elon Musk, with his toothless, empty threats on his way out the door of DOGE, glibly stated, “someone should look into the Fed.”

Really? Is that it? What an absolute fucking joke.

It is fucking amazing that Trump’s economic advisor (Miran) wants to now indebt the US with 100 year TOKENIZED bonds, so we can be skimmed for another fucking century by these insolvent frauds.

https://nypost.com/2025/04/27/business/federal-reserve-blows-2-5b-on-palace-of-versailles-hq/

https://archive.is/fpJ4J

This project DWARFED all other government building projects ever. And the real kicker is the broke-ass Fed is BORROWING this money from taxpayers for the project.

And note: Powell just got caught lying to Congress about this and revealed during the hearing that IT IS NOW $3.1 BILLION

Wtf

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:14:02 PM

No.514879270

[Report]

9/5/2025, 5:14:02 PM

No.514879270

[Report]

>>514879182

LOL

>23,000 fucking employees and they can't afford to issue the citizens' fucking currency

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:15:38 PM

No.514879385

[Report]

9/5/2025, 5:15:38 PM

No.514879385

[Report]

i have some things to do

but will be in and out to bump

Anonymous

(ID: lai0bBjm)

9/5/2025, 5:16:07 PM

No.514879428

[Report]

9/5/2025, 5:16:07 PM

No.514879428

[Report]

Anonymous

(ID: RE5dl3SV)

9/5/2025, 5:16:24 PM

No.514879456

[Report]

>>514864246 (OP)

Good posts ITT excluding the retarded OP. As genetic trash I want to kill myself so bad, so nothing would make me happier than seeing the crash I've been hoping for. Been wishing for it since I started meme posting Ebola-chan 11 years ago.

I just can't take this programmer non-high wage cuck slavery while being an ugly male without a wholesome wife and kids to provide for. I just want this shit to burn, please just burn. Suffering and death for all.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:16:57 PM

No.514879494

[Report]

9/5/2025, 5:16:57 PM

No.514879494

[Report]

Daily reminder:

The State Capitalist/Communist Regime of the Federal Reserve Uniparty

There is Free Market Capitalism, which we do NOT practice. This is when you have competition & the rewarding of success.

We practice State Capitalism (low-grade communism) in which the central bank rewards their buddies whether or not they are successful. They also launder their worthless Federal Reserve Notes into real assets while doing so, which are then held by their private corporation. This is State Capitalism.

Again, NOT to be confused with free market capitalism, which is probably only truly practiced somewhere in the Andes.

The Federal Reserve is a group of 12 private, incorporated, regional franchises (they can each be sued) & is the driving force behind the corporate takeover of our government.

State Capitalism (aka low grade communism directed by the central bank):

>the state has considerable control over the allocation of credit & investment

>planning to protect & advance the interests of big business against the interests of consumers.

>government controls the economy & essentially acts like a single huge corporation

>publicly listed corporations in which the state has controlling shares

The Fed con laid out in 105 posts.

https://archive.4plebs.org/pol/thread/306098770/

Correction in archived thread: change mortgagee to mortgagor

Fed info & links to house & senate crypto summaries:

https://archive.4plebs.org/pol/thread/329381702/

Criminal activities of the NYFed's primary dealers

https://archive.4plebs.org/pol/thread/342538518/

The NYFed investing in China:

https://archive.4plebs.org/pol/thread/359651784/#359683568

Ukraine & its owner, the NYFed:

https://archive.4plebs.org/pol/thread/373203255/

Fed thread:

https://archive.4plebs.org/pol/thread/389999787/

June 2023 Fed thread:

https://archive.4plebs.org/pol/thread/428705533/

The irony here is that we are, in real time right now, witnessing the failure of low grade communism, aka state capitalism.

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:18:41 PM

No.514879620

[Report]

9/5/2025, 5:18:41 PM

No.514879620

[Report]

we are witnessing the failure of low grade communism, state capitalism by the Fed, in real time

>SOS we've been hijacked

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:20:06 PM

No.514879731

[Report]

>>514879874

>>514881254

9/5/2025, 5:20:06 PM

No.514879731

[Report]

>>514879874

>>514881254

the NYFed is operating on $12B in capital and in the hole itself ~$144B today

this is all that the largest owners of the NYFed (the primary dealers mostly), would be held accountable for, if they failed, lol, you would think the FBI would give a fuck about this, since the NYFed claims to have almost $10T in assets

Thread from Feb 6th 2025 194 posts

https://archive.4plebs.org/pol/thread/496654194

200 post thread from Nov 10 2024

https://archive.4plebs.org/pol/thread/487963430/#q487963430

the great irony here, is the more cash the public uses, the more it forces the Fed franchises to hold the interest-free fiat as liabilities (aka CIC cash in circulation) and thus, making US taxpayers’ dollars less available to be spent paying out the liabilities of IORB to primary dealers and interest on reverse repo transactions to MMFs

Lillitts9

(ID: pPK1BO1r)

9/5/2025, 5:20:52 PM

No.514879789

[Report]

9/5/2025, 5:20:52 PM

No.514879789

[Report]

>>514866500

Lmao hey thanks for pulling all that out of your ass, faggot boomer

Anonymous

(ID: VWNzL2wt)

9/5/2025, 5:21:00 PM

No.514879798

[Report]

9/5/2025, 5:21:00 PM

No.514879798

[Report]

>>514864246 (OP)

That's what happens at the end of a bubble

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:22:13 PM

No.514879874

[Report]

9/5/2025, 5:22:13 PM

No.514879874

[Report]

>>514879731

>the great irony here, is the more cash the public uses, the more it forces the Fed franchises to hold the interest-free fiat as liabilities (aka CIC cash in circulation) and thus, making US taxpayers’ dollars less available to be spent paying out the liabilities of IORB to primary dealers and interest on reverse repo transactions to MMFs

pic rel from kupiec jan 2024 paper

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:40:42 PM

No.514881099

[Report]

>>514881165

9/5/2025, 5:40:42 PM

No.514881099

[Report]

>>514881165

Federal Reserve Thread Series Part 1 of 4

https://archive.4plebs.org/pol/thread/489468608

This thread summarizes the first of a series of four recent separate economics papers examining the current insolvency of the 12 regional Federal Reserve franchises.

In this first paper, Kupiec and Pollock show that the Federal Reserve franchises are insolvent if GAAP accounting is used, which the Fed does not use. The Fed is now balancing their books with an imaginary, 'magic' accounting column called 'Deferred Assets' to perpetuate their bankrupting of the US Treasury and the American taxpayer and to hide their losses and now uncollateralized Federal Reserve Notes. These are operating losses, which don't even include the capital losses from marking-to market their now-worthless securities either, further skewing the real price of credit and hampering the Fed's ability to respond to shocks to the economy, as their balance sheet is full and there is no room to move.

The Fed franchises have only become more insolvent since the paper was released, their losses doubling since Jan 2024 to the tune of ~$214 Billion as of this week.

This thread summarizes how the Fed is insolvent, operating illegally, opening itself up for lawsuits and destroying the American economy when it could just roll off its balance sheet and take cash losses like that. Instead, the Fed franchises choose to take cash losses by still paying their owners dividends and paying out interest to NYFed primary dealers via IORB and to MMFs in Reverse Repo transactions.

’Federal Reserve Losses and Monetary Policy’ Jan 2024

Paul H. Kupiec, Senior Fellow, American Enterprise Institute

Alex J. Pollock, Senior Fellow, Mises Institute

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4712022

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:41:29 PM

No.514881165

[Report]

>>514881226

>>514881502

9/5/2025, 5:41:29 PM

No.514881165

[Report]

>>514881226

>>514881502

>>514881099

Federal Reserve Thread Series Part 2 of 4

https://archive.4plebs.org/pol/thread/491506260/

This thread summarizes the second of a series of four recent separate economics papers examining the current insolvency of the 12 regional Federal Reserve franchises (aka ‘Fed bank/s’ ITT). This paper uses Ordinary Least Squares (OLS) linear regression analysis to examine how shocks from three variables: federal debt, the Federal Reserve assets and/or real GDP affect CPI (chosen to represent prices and inflation).

Mr. Webster’s paper describes how quickly prices respond to shocks in the above three variables and how quickly a new (often higher) price equilibrium is found and how the rest of the system converges to support this new price equilibrium. This paper seeks to measure how quickly the now-insolvent Fed banks enable or ‘accommodate’ the deficit-ridden US government by purchasing securities and how this accommodation then contributes to inflation and price hikes, as measured by CPI.

The Fed banks’ ‘accommodative’ QE purchases of excess US Marketable Debt make room for even more new debt to be issued and *hopefully* sold. This is called Fed ‘accommodation’ and is now becoming a ‘debt death spiral’, which is when a nation (or corporation) has to issue new debt to raise the funds to pay the interest on its old debt. Unfortunately, this new constant debt issuance floods the economy with new currency, mostly enriching the proximal investment class and exacerbating inflation for the rest of us. These QE policies have also led to the insolvency of the Federal Reserve today, massive capital losses and full balance sheets with no room for the Fed to move, further handicapping the debt-based central bank.

The Myth of Fed Political Independence

Thomas J. Webster, Professor Emeritus, Lubin School of Business, Pace University, New York, NY.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4916388

Anonymous

(ID: cVhqXaNB)

9/5/2025, 5:42:15 PM

No.514881226

[Report]

>>514881279

>>514881502

9/5/2025, 5:42:15 PM

No.514881226

[Report]

>>514881279

>>514881502

>>514881165

Federal Reserve Thread Series Part 3 of 4

https://archive.4plebs.org/pol/thread/494723606/