Search Results

ID: C9ngPLUA/biz/60672913#60680415

7/23/2025, 8:54:49 PM

>>60680204

See

>>60680295

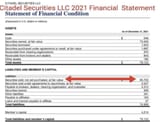

We don't want anything to do with this balance sheet. It looks like a balloon waiting to get pricked. The complex networking of swaps and derivatives could make this infinitely MORE dangerous that you see at first glance here. (certainly not less dangerous)

See

>>60680295

We don't want anything to do with this balance sheet. It looks like a balloon waiting to get pricked. The complex networking of swaps and derivatives could make this infinitely MORE dangerous that you see at first glance here. (certainly not less dangerous)

ID: mNJe07Kj/biz/60660290#60662803

7/20/2025, 7:13:20 PM

>>60662749

It has $9BN in cash on hand, no debt, and a $10BN market cap. It has also been theorized that a massive short squeeze is latent in this stock which is why the company has such a bizarre valuation.

During the 2008 crash, VW literally did the exact opposite which is charactering of naked-short-sold securities.

A crash is a cascade of selling.

Naked short sold equities such as GME (and VW) have the opposite problem. They have a cascade of market BUYING.

Smart money is seeing the similarities and finding that the systemic-naked-short-selling thesis is 100% factually real. So game theory shows that all you need to do is buy up as much as you can. This 100% shields you from market collapse and will also give you the opportunitity of a lifetime to sell an asset at its all time high to buy up blue chips and everything else when they are on a firesale.

This is 100% proven FACT and there is nothing that can be done to stop it.

It has $9BN in cash on hand, no debt, and a $10BN market cap. It has also been theorized that a massive short squeeze is latent in this stock which is why the company has such a bizarre valuation.

During the 2008 crash, VW literally did the exact opposite which is charactering of naked-short-sold securities.

A crash is a cascade of selling.

Naked short sold equities such as GME (and VW) have the opposite problem. They have a cascade of market BUYING.

Smart money is seeing the similarities and finding that the systemic-naked-short-selling thesis is 100% factually real. So game theory shows that all you need to do is buy up as much as you can. This 100% shields you from market collapse and will also give you the opportunitity of a lifetime to sell an asset at its all time high to buy up blue chips and everything else when they are on a firesale.

This is 100% proven FACT and there is nothing that can be done to stop it.

Page 1