Search Results

7/25/2025, 9:01:59 PM

7/20/2025, 7:15:28 PM

>>510882048

Damn, poo Vance vs poo (I forgot that faggots name and refuse to look it up).

Damn, poo Vance vs poo (I forgot that faggots name and refuse to look it up).

7/20/2025, 5:42:01 AM

ID: AZUDLgQa/pol/510598160#510598904

7/17/2025, 5:38:00 AM

7/16/2025, 9:27:53 AM

ID: MPsIeZf//pol/510501168#510509189

7/16/2025, 6:08:38 AM

7/16/2025, 4:59:26 AM

>>510504363

yet none of them ever want to go back to that disgusting shithole of animal raping subhumans. Total poo death. Trips and Pakistan nukes the fuck out of India in 2027.

yet none of them ever want to go back to that disgusting shithole of animal raping subhumans. Total poo death. Trips and Pakistan nukes the fuck out of India in 2027.

7/15/2025, 3:59:39 PM

ID: IMc9j+SL/pol/510339301#510339497

7/14/2025, 9:27:31 AM

7/13/2025, 3:14:06 PM

7/13/2025, 12:48:00 AM

7/13/2025, 12:32:06 AM

>>510212437

They even had to gang rape a lizard....

They even had to gang rape a lizard....

7/9/2025, 1:57:56 AM

7/8/2025, 1:38:51 AM

7/2/2025, 9:56:13 PM

>>509328127

India is a shithole, and they export .0001% of the non-retarded ones to try to trick the world that they aren't a genetic and cultural mistake.

India is a shithole, and they export .0001% of the non-retarded ones to try to trick the world that they aren't a genetic and cultural mistake.

6/23/2025, 12:38:13 PM

5/14/2025, 6:27:56 PM

https://www.financialexpress.com/business/investing-abroad-us-to-levy-5-tax-on-immigrant-remittances-what-does-it-mean-for-nris-3844718/

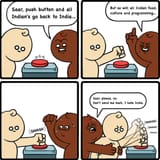

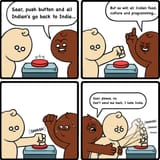

A new tax proposal by House of Republicans could significantly impact Non-Resident Indians (NRIs) living in the United States. The bill, introduced on May 12, 2025, includes a controversial provision imposing a 5% tax on international money transfers made by non-citizens. This development depicts a significant shift in U.S. tax policy, especially for foreign workers who regularly send money to their families abroad.

The broader bill aims to make the 2017 Tax Cuts and Jobs Act permanent while increasing the standard deduction and extending the child tax credit to $2,500 through 2028. US President Donald Trump, currently serving his second term, has publicly endorsed the legislation, calling it “GREAT” and urging Republicans to ensure its passage. The 5% remittance tax is intended to help fund extended tax breaks and support border security initiatives, potentially raising billions for the U.S. Treasury. However, it does so at the direct expense of hardworking immigrants.

For NRIs, this tax could have profound financial implications. Currently, India is the world’s top recipient of remittances, with around $83 billion sent annually from abroad, much of it from the United States. The new provision would mean that for every ₹1 lakh (in dollar terms) sent home, ₹5,000 (in dollar terms) would go to the IRS before reaching the intended recipients. This change affects everyday family support, property purchases, educational expenses, and more. Until now, remittances were not subject to U.S. taxation, making this a stark policy reversal.

A new tax proposal by House of Republicans could significantly impact Non-Resident Indians (NRIs) living in the United States. The bill, introduced on May 12, 2025, includes a controversial provision imposing a 5% tax on international money transfers made by non-citizens. This development depicts a significant shift in U.S. tax policy, especially for foreign workers who regularly send money to their families abroad.

The broader bill aims to make the 2017 Tax Cuts and Jobs Act permanent while increasing the standard deduction and extending the child tax credit to $2,500 through 2028. US President Donald Trump, currently serving his second term, has publicly endorsed the legislation, calling it “GREAT” and urging Republicans to ensure its passage. The 5% remittance tax is intended to help fund extended tax breaks and support border security initiatives, potentially raising billions for the U.S. Treasury. However, it does so at the direct expense of hardworking immigrants.

For NRIs, this tax could have profound financial implications. Currently, India is the world’s top recipient of remittances, with around $83 billion sent annually from abroad, much of it from the United States. The new provision would mean that for every ₹1 lakh (in dollar terms) sent home, ₹5,000 (in dollar terms) would go to the IRS before reaching the intended recipients. This change affects everyday family support, property purchases, educational expenses, and more. Until now, remittances were not subject to U.S. taxation, making this a stark policy reversal.

Page 1