/pmg/ - Precious Metals General

Anonymous

(ID: G8PVdLnn)

7/3/2025, 5:16:23 PM

No.60577602

[Report]

>>60579450

Anonymous

(ID: G8PVdLnn)

7/3/2025, 5:17:25 PM

No.60577612

[Report]

>>60580129

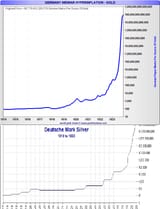

and also picrel

Anonymous

(ID: a6xNRFjS)

7/3/2025, 5:20:09 PM

No.60577626

[Report]

>>60577585 (OP)

>baird bar

neat

4th of July/Friday doomp incoming

Anonymous

(ID: a6xNRFjS)

7/3/2025, 6:21:49 PM

No.60577942

[Report]

mail pls

Anonymous

(ID: MIZVrrao)

7/3/2025, 7:15:12 PM

No.60578170

[Report]

Nothing dumber than IQDelete

Anonymous

(ID: O+LGTSU1)

7/3/2025, 7:16:59 PM

No.60578178

[Report]

>>60577636

>friday dump

used to bug me, but I've been warming to the idea that my DCA works a bit better if I buy on fridays.

Anonymous

(ID: 5vL2Zfle)

7/3/2025, 7:24:53 PM

No.60578215

[Report]

>>60578314

>>60578347

>>60581103

>>60577636

Speaking of the 4th, there is alot of buzz in NY about the tribe being advised to leave the city. Possible happening incoming.

Why don't companies buy gold and silver like they do Bitcoin?

Anonymous

(ID: +/rvZI5c)

7/3/2025, 7:43:37 PM

No.60578284

[Report]

>>60578242

Storage probably

Anonymous

(ID: 4f/Vs7MW)

7/3/2025, 7:43:40 PM

No.60578285

[Report]

Peter Schiff is passionate about minors

Anonymous

(ID: C0oh8VjQ)

7/3/2025, 7:48:39 PM

No.60578305

[Report]

>>60578242

They do. Gold is the second largest asset held right now after the US Dollar.

Anonymous

(ID: O+LGTSU1)

7/3/2025, 7:51:22 PM

No.60578314

[Report]

>>60578329

>>60578347

>>60578215

>buzz about leaving the city

where are you hearing about this? or is this a /pol thing?

Anonymous

(ID: EV/EkFGf)

7/3/2025, 7:53:42 PM

No.60578325

[Report]

>>60578242

>Why don't companies buy gold and silver

THEY cant afford it

Anonymous

(ID: 5vL2Zfle)

7/3/2025, 7:54:44 PM

No.60578329

[Report]

>>60578347

>>60578314

It's all over the place, threads on pol too.

Anonymous

(ID: O+LGTSU1)

7/3/2025, 7:54:58 PM

No.60578332

[Report]

>>60578242

custody/storage probably.

They're only treading water financially by buying btc/eth, as they're essentially still fiat, held in a different kind of account. Maybe they prefer this over banks/investment companies, as there is potentially less regulation?

Anonymous

(ID: qeTiowRo)

7/3/2025, 7:57:18 PM

No.60578345

[Report]

>>60578242

They do, you're just to stupid to pay attention.

Anonymous

(ID: 5S5Hoc8W)

7/3/2025, 7:57:30 PM

No.60578347

[Report]

>>60580140

>>60578215

>>60578314

>>60578329

They could drop a nuke on newyork and i'll still be stacking

I wanna exchange like $3k of fiat for silver. Should I go all ASE or 10oz bars or what? Don't over think it?

Anonymous

(ID: EfG7KyJZ)

7/3/2025, 8:16:17 PM

No.60578419

[Report]

>>60578370

How much will you instantly lose? $500?

Anonymous

(ID: AffY6h/g)

7/3/2025, 8:16:29 PM

No.60578420

[Report]

>>60578441

Does anyone know why EMX Royalty Corporation closed up almost 4% today? Gold was slightly down and silver just slightly up. GDX also just slightly up. Would love to know if any anons can fill me in.

Anonymous

(ID: AffY6h/g)

7/3/2025, 8:23:53 PM

No.60578439

[Report]

>>60578370

1oz coins from government mints are best and most liquid. Doesn’t have to be US mint. You can go for Canada, UK etc. As close to spot as possible.

Anonymous

(ID: EfG7KyJZ)

7/3/2025, 8:25:00 PM

No.60578441

[Report]

>>60578420

pmg doesn't believe in stocks they only buy stuff with huge fees to coin merchants, I recommended SBSW to them and they claimed it wasn't real and CEDE and Co owns it. Schizo level shit. Now I'm up 150% on it year to date

Anonymous

(ID: a6xNRFjS)

7/3/2025, 8:29:30 PM

No.60578454

[Report]

>>60578463

>>60579755

ponder the number of pies that will be made this holiday weekend

Anonymous

(ID: a6xNRFjS)

7/3/2025, 8:31:10 PM

No.60578463

[Report]

Anonymous

(ID: wT3wv36O)

7/3/2025, 9:04:14 PM

No.60578602

[Report]

all that matters is physical rocks

period

Anonymous

(ID: +/rvZI5c)

7/3/2025, 9:09:10 PM

No.60578623

[Report]

>>60578370

Mix things up, get a couple bars, some coins, some rounds, just stuff you like

Anonymous

(ID: fYlGA117)

7/3/2025, 9:17:00 PM

No.60578658

[Report]

>>60578661

Anonymous

(ID: a6xNRFjS)

7/3/2025, 9:17:39 PM

No.60578661

[Report]

Anonymous

(ID: 5vL2Zfle)

7/3/2025, 9:18:06 PM

No.60578667

[Report]

>>60578741

>>60579630

>>60578370

I like the idea of ASEs because its the "coin of the realm" if you're a burger but if your stacking for weight bars are a little cheaper.

Anonymous

(ID: +/rvZI5c)

7/3/2025, 9:31:54 PM

No.60578728

[Report]

>>60578703

Too bad the eagle on it looks retarded now

Anonymous

(ID: 9MGinhVH)

7/3/2025, 9:35:55 PM

No.60578741

[Report]

>>60578799

>>60578667

I just hate the premiums

Anonymous

(ID: 5vL2Zfle)

7/3/2025, 9:42:50 PM

No.60578775

[Report]

>>60578815

>>60579036

>>60578703

>these coins are limited to a production of just 500,000 coins, making them one of the lowest mintage Silver Eagles to date.

I suppose this is appealing to coin collectors but it doesn't seem worth it.

Anonymous

(ID: 5vL2Zfle)

7/3/2025, 9:49:23 PM

No.60578799

[Report]

>>60578819

>>60579630

>>60578741

I hear you can get used ASEs cheap right now at LCS because everyone is broke. So you can get near mint quality for just a few bucks over spot. Less premium than new anyway.

Anonymous

(ID: 2WeabL7v)

7/3/2025, 9:51:46 PM

No.60578809

[Report]

>>60580157

>>60583537

So many wins for Bitcoin but begs the question why they don't do this for silver....lmao because no one buys stuff with silver

Anonymous

(ID: 2WeabL7v)

7/3/2025, 9:54:20 PM

No.60578815

[Report]

>>60578775

They aren't really coins they are commemorative rounds and retards will buy them thinking there will be more demand In the future. Garunteed losers

Anonymous

(ID: 2WeabL7v)

7/3/2025, 9:56:05 PM

No.60578819

[Report]

>>60578799

>Less premium than new anyway.

Pmg was paying $50 for them 5 years ago saying they would get their premium back in one day...lmao why do they argue with me

Anonymous

(ID: hDXg0Emy)

7/3/2025, 10:17:34 PM

No.60578900

[Report]

>>60579966

get filtered faggot

Anonymous

(ID: qeTiowRo)

7/3/2025, 10:35:59 PM

No.60578946

[Report]

>>60579014

>>60579630

So many wins for precious metals but begs the question why they don't do this for bitcorn....lmao because no one wants bitcorn

Anonymous

(ID: B6yCE9s4)

7/3/2025, 10:54:50 PM

No.60579014

[Report]

>>60578946

>green ID

Based.

Anonymous

(ID: ZIbcdbR2)

7/3/2025, 10:59:17 PM

No.60579036

[Report]

>>60579078

>>60580167

>>60578775

Never understood collecting government bullion. No connection to history.

>i paid my rapist $20 for a special silver coin with a nigger on it

Ridiculous.

Anonymous

(ID: a6xNRFjS)

7/3/2025, 11:11:37 PM

No.60579078

[Report]

>>60579666

>>60579036

do they force you to keep these threads alive or something?

Anonymous

(ID: b6FOCgvJ)

7/3/2025, 11:20:11 PM

No.60579096

[Report]

>>60579122

Ruthenium up 6.4% on the day, 100% in the last 8 months or so

Anonymous

(ID: qeTiowRo)

7/3/2025, 11:26:57 PM

No.60579122

[Report]

>>60579541

>>60579096

>Ruthenium

Second one in from the left is ruthenium and platinum plated. Am I going to make it?

Anonymous

(ID: Dgbw3OVc)

7/3/2025, 11:27:29 PM

No.60579124

[Report]

I just realized my LCS and my not so LCS is probably going to be closed all weekend because of the holiday

Saturday would have been an excellent day for a road trip to Delaware

Anonymous

(ID: wLnbovtI)

7/3/2025, 11:51:21 PM

No.60579201

[Report]

>>60579209

>>60579541

>>60577585 (OP)

>37 bucks an ounce of silver

I'm trading my 70+ oz shit on Saturday and get a gold Krug.

It was not a good run and I deeply regret buying silver. However I am really happy with my gold and will support the gold movement from now on.

>>60578370

>buying silver at these prices

Just wait until 2026. Silver will go 20 bucks an ounce on January as clean energy technologies stop being deductible.

>>60577636

I have a hunch it will rise to 38/oz. 4th of July will not be as celebrated because of political division in America.

Anonymous

(ID: +/rvZI5c)

7/3/2025, 11:53:43 PM

No.60579209

[Report]

>>60579225

>>60579242

>>60579201

I suspect it will dump just because that's usually what happens on long weekends, not the particular holiday

Anonymous

(ID: NmTNv7T3)

7/3/2025, 11:57:53 PM

No.60579225

[Report]

>>60579242

>>60579966

>>60579209

>I suspect it will dump just

Why don't you use your super skill to see future price movements and get rich? Lmao because you don't believe your own bs

Anonymous

(ID: wLnbovtI)

7/4/2025, 12:05:08 AM

No.60579242

[Report]

>>60579209

True.

>>60579225

MasterCardjeet, pls.

Anonymous

(ID: fYlGA117)

7/4/2025, 12:12:47 AM

No.60579262

[Report]

>>60579303

Anonymous

(ID: NmTNv7T3)

7/4/2025, 12:25:36 AM

No.60579303

[Report]

>>60579966

>>60579262

>coin merchant says buy gold

Lmao, why does pmg believe everything the coin merchants say?

Anonymous

(ID: fYlGA117)

7/4/2025, 1:14:12 AM

No.60579438

[Report]

>>60580335

I get all of my trading advice from openly queer/lgbbq indian guys on 4chan (I immediately disregard it though).

Anonymous

(ID: D8HO/rdy)

7/4/2025, 1:18:12 AM

No.60579450

[Report]

>>60579473

>>60581530

>>60577602

That’s one fake ass silver eagle

Anonymous

(ID: D8HO/rdy)

7/4/2025, 1:27:29 AM

No.60579473

[Report]

>>60581530

>>60579450

And you can believe me because my ID says date-ho-ready

Anonymous

(ID: ygFgER8L)

7/4/2025, 1:41:45 AM

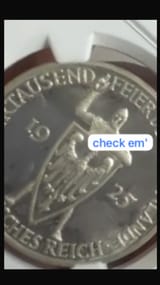

No.60579513

[Report]

>>60579520

>>60579541

Hooray for German Talers

Anonymous

(ID: a6xNRFjS)

7/4/2025, 1:44:17 AM

No.60579520

[Report]

>>60581922

>>60579513

how many months has it been

Anonymous

(ID: 8AyMlEqx)

7/4/2025, 1:50:48 AM

No.60579541

[Report]

>>60579875

>>60580496

>>60581922

>>60579201

You're swapping to gold... Now? Anon... Are you still valuing PMs in Fiat?

You don't swap silver to gold when the ratio is 100/1. Ffs just wait till the ratio corrects (like it has been for weeks) and get your gold while still keeping some silver.

Gold and platinum picrel. Don't have a pic with all three metals that fits size limits.

>>60579513

YOOO! What did those set you back over melt? They look dope AF.

>>60579122

Depends anon.did those pandas come for m china? Cause i'ld go get them tested if they did.

Anonymous

(ID: NmTNv7T3)

7/4/2025, 1:55:36 AM

No.60579562

[Report]

>>60579696

>>60580342

>>60580346

Top investment advisor recommends 40% allocation to crypto, 0% to precious metals. Says it's risky to NOT own crypto

Anonymous

(ID: /UWKnoIQ)

7/4/2025, 2:15:45 AM

No.60579630

[Report]

>>60579632

>>60580103

>>60580496

>>60578667

>>60578703

>>60578799

How do you guys feel about the Army Privy ASE? It's back for "pre-order" on the US Mint. Here are some details since fagchan only allows one image:

Limited Mint: 100,000

Only 1 per household

Price: $105 + I'm assuming shipping jew

Seems like it'd be a decent flip, but I'd rather have the US Navy Privy Mark, just cus sentimentality, not to flip.

>>60578946

Winning this easily:

>just buy stupid boomer rocks...

>profit

>lol

Anonymous

(ID: NmTNv7T3)

7/4/2025, 2:17:38 AM

No.60579632

[Report]

>>60579630

Lmao $105 for a round from the government you hate

Anonymous

(ID: a6xNRFjS)

7/4/2025, 2:34:18 AM

No.60579665

[Report]

>>60579759

>>60579866

>>60580010

Anonymous

(ID: ZIbcdbR2)

7/4/2025, 2:34:20 AM

No.60579666

[Report]

>>60579744

>>60580167

>>60579078

I just find government bullion profoundly disgusting. Like, you hate the government but give them free money to mint ugly shit because the boomer coin bodega you're used to gives you better resale on government products. It's nasty.

Anonymous

(ID: pDg52as8)

7/4/2025, 2:43:00 AM

No.60579696

[Report]

>>60581289

>>60579562

There is no such thing as a good investment advisor.

Anonymous

(ID: weWIINp0)

7/4/2025, 2:55:49 AM

No.60579744

[Report]

>>60580078

>>60579666

Hey Satan, we're trading their fiat back for real money. It's poetic. They're making the worst trade in modern history.

If you're not draining your government or foreign governments of their silver while trading them for their dying fiats, are you even a true stacker?

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 2:57:40 AM

No.60579751

[Report]

>>60577585 (OP)

>A Little of Everything Edition

>

You left out so much...

Like "fiberglass" it's the new bitcoin...

Anonymous

(ID: gtc2fiFK)

7/4/2025, 2:59:25 AM

No.60579755

[Report]

>>60579759

>>60580000

>>60578454

Beautiful coin whats it called? Also that's either a tiny coin or those are huge blocks of cheese

Anonymous

(ID: a6xNRFjS)

7/4/2025, 3:01:35 AM

No.60579759

[Report]

>>60579794

>>60579755

>>60579665

that's 12 pounds of cheese fren

Anonymous

(ID: NmTNv7T3)

7/4/2025, 3:03:22 AM

No.60579765

[Report]

Dozens of companies buying bitcoin......none buying precious metals

Anonymous

(ID: NmTNv7T3)

7/4/2025, 3:07:22 AM

No.60579778

[Report]

Lmao it's funny that pmg not only recommends buying physical metal with the highest premiums but the worst tax rates

Lmao buy an etf you can get 0% federal ltcg tax

Buy physical, tax rate ip to 37% plus state tax

That's a deal breaker for anyone with a brain

Anonymous

(ID: weWIINp0)

7/4/2025, 3:15:04 AM

No.60579794

[Report]

>>60580000

>>60579759

>12 pounds of cheese

I brought the 6lbs of burgers. Because I like a little beef with my cheese.

Anonymous

(ID: /UWKnoIQ)

7/4/2025, 3:35:11 AM

No.60579842

[Report]

Have made nothing but profits off all of my Silver...

IQDalit is still maldin' and seethin' and generally just being an unwashed poorfag...

>Life's good

Anonymous

(ID: HgXVfWiY)

7/4/2025, 3:44:38 AM

No.60579864

[Report]

>>60578703

bix says since regular ase's are on allocation theyre not even supposed to make anything else until they fill those orders

Anonymous

(ID: bJajBpih)

7/4/2025, 3:45:14 AM

No.60579866

[Report]

>>60580000

>>60579665

What's up with this background pic of boy and his mining lamp? Why u always using it?

Anonymous

(ID: HgXVfWiY)

7/4/2025, 3:49:22 AM

No.60579875

[Report]

>>60579541

when you upload a pic on the bottom there's a size menu you can click and pick like large and it should work instead of actual size if that's what you meant

Anonymous

(ID: NmTNv7T3)

7/4/2025, 3:54:22 AM

No.60579892

[Report]

>>60579966

>>60580084

The only worse investment than precious metals is putting money under your mattress

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 4:03:21 AM

No.60579918

[Report]

>>60579954

>>60577636

I could stand to stack some moar

Anonymous

(ID: weWIINp0)

7/4/2025, 4:15:11 AM

No.60579954

[Report]

>>60581338

Sage

(ID: cZT/2wu1)

7/4/2025, 4:20:27 AM

No.60579966

[Report]

>>60579985

>>60578900

>>60579225

>>60579303

>>60579892

Can Jannie’s please IP ban this literal Mossad NIGGER

Anonymous

(ID: weWIINp0)

7/4/2025, 4:27:41 AM

No.60579985

[Report]

Anonymous

(ID: a6xNRFjS)

7/4/2025, 4:35:55 AM

No.60580000

[Report]

>>60580004

>>60580010

>>60579794

Burgers sound good right now

>>60579866

It is one of the anonymintpm mats. I just think it works well for pictures since it is only black and white.

>>60579755

It is called The Frank on Horseback. Just a commemorative coin from France. I liked the design and the odd size, weight, and purity.

Anonymous

(ID: weWIINp0)

7/4/2025, 4:37:18 AM

No.60580004

[Report]

>>60580000

>Burgers

A few are for tomorrow and most for a party Saturday.

Anonymous

(ID: a6xNRFjS)

7/4/2025, 4:39:48 AM

No.60580010

[Report]

>>60579665

>>60580000

>45g

>47mm

I'll ask again, why not. Does anyone know of a coin larger than this? And not a bullion kilo or something like that.

Anonymous

(ID: ZIbcdbR2)

7/4/2025, 5:12:31 AM

No.60580078

[Report]

>>60580130

>>60580208

>>60579744

>are you even a real stacker if you don't give free money to the government

Anonymous

(ID: ZIbcdbR2)

7/4/2025, 5:18:19 AM

No.60580084

[Report]

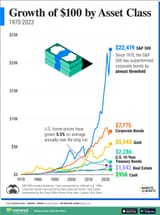

>>60579892

>36 years

Oddly specific time frame. Tradingview, what happens if we make it an even 25?

Anonymous

(ID: 5vL2Zfle)

7/4/2025, 5:24:59 AM

No.60580103

[Report]

Anonymous

(ID: 1TAu7U8+)

7/4/2025, 5:41:19 AM

No.60580129

[Report]

>>60577612

i foun’ dey sail foams!

>beleebit!

Anonymous

(ID: weWIINp0)

7/4/2025, 5:41:27 AM

No.60580130

[Report]

>>60580168

>>60580078

>money

Fiat is currency, not money. Gold and silver are money. Fiat is credit, a debt receipt.

Anonymous

(ID: 1TAu7U8+)

7/4/2025, 5:46:24 AM

No.60580140

[Report]

>>60578347

‘mirin the cut of your jib, good sir!

>also, 2nd’d

Anonymous

(ID: 1TAu7U8+)

7/4/2025, 5:54:11 AM

No.60580157

[Report]

>>60581418

>>60578809

that is a man…

Anonymous

(ID: 1TAu7U8+)

7/4/2025, 6:02:59 AM

No.60580167

[Report]

>>60580232

>>60579036

>>60579666

>NO government mint employee ever called me nigger, wanted me to cut off my sons penis, or cut off my daughters breasts…

get a better script, chud!

Anonymous

(ID: ZIbcdbR2)

7/4/2025, 6:03:02 AM

No.60580168

[Report]

>>60580244

>>60580130

why are you still stacking if you have infinite currency?

if you don't have infinite currency, why are you giving any of it to the government FOR FREE?

Anonymous

(ID: nDXSCcz1)

7/4/2025, 6:21:26 AM

No.60580208

[Report]

>>60580232

>>60580078

Retard alert. Trading my monopoly money for hard assets like gold and silver is a way better idea then a currency that can die tomorrow. Have you seen our national debt? Boomer rocks are eternal.

Anonymous

(ID: ZIbcdbR2)

7/4/2025, 6:34:42 AM

No.60580232

[Report]

>>60580167

>>60580208

wow all these government employees sure get angy when they have to explain why they need a 4x+ bigger cut than private refiners

Anonymous

(ID: weWIINp0)

7/4/2025, 6:40:58 AM

No.60580244

[Report]

>>60580168

>why are you giving any of it to the government FOR FREE?

You're a retard. I said I give fiat currency for silver aka real money.

Fuckin ESL monkey.

Anonymous

(ID: 1TAu7U8+)

7/4/2025, 7:19:08 AM

No.60580335

[Report]

>>60579438

>this!

bloody benchod pushes the shit in of other bloody benchod!

beleebit!

Anonymous

(ID: 1TAu7U8+)

7/4/2025, 7:24:00 AM

No.60580342

[Report]

>>60579562

why does this guy speak like a shabbos goyim?

>buy crypto or else…

i hate yiddish, financial word salad…

reads like written monk pox to me

Anonymous

(ID: 8cpxEQyW)

7/4/2025, 7:26:50 AM

No.60580346

[Report]

>>60580618

>>60579562

>Pump my bags please

>The post

Anonymous

(ID: SHtQCc3D)

7/4/2025, 8:55:44 AM

No.60580496

[Report]

>>60580499

>>60579541

>You don't swap silver to gold when the ratio is 100/1.

This has been taking forever, and I really don't want the GSR to go beyond 125:1 or even more, which I feel it can theoretically happen if Trump no longer cares about gold being a threat to dedollarization and instead encourages it since commodities are still priced in USD.

I have been pondering and looking at my PMs, so I guess I will wait until the first week of November so the GSR goes at least 65:1 and silver is about 43/oz, hopefully.

>>60579630

>ANOTHER privy besides the eagle one

This is an obvious marketing scheme appealing to "patriotic" neocon boomers who have way too much money.

It would be much better if all the designers for the yearly platinum proof eagle also made designs for ASEs.

What would the design be about, I don't know, animals native to the U.S./North America?

Anonymous

(ID: SHtQCc3D)

7/4/2025, 8:58:28 AM

No.60580499

[Report]

>>60580496

Oh shoot, my ID changed.

Anonymous

(ID: NmTNv7T3)

7/4/2025, 10:27:16 AM

No.60580618

[Report]

>>60580346

Unlike silver, bitcoin doesn't need to be shilled. That's why you will find 1 million ads on YouTube shilling silver and 0 for bitcoin.....lmao coin merchants get rich off yall because you believe the ads and everything the coin merchants say and collectively pay $billions in premiums to the coin merchants

Anonymous

(ID: hDXg0Emy)

7/4/2025, 11:25:41 AM

No.60580705

[Report]

bro just outright lies through his teeth

Anonymous

(ID: a6xNRFjS)

7/4/2025, 1:36:33 PM

No.60580900

[Report]

Another one submits

LMAO

Anonymous

(ID: LLyEMa3g)

7/4/2025, 2:46:45 PM

No.60581020

[Report]

Good morning and Happy 4th, my fellow shiny rock enjoyers

Anonymous

(ID: AslCJ14/)

7/4/2025, 3:21:31 PM

No.60581103

[Report]

>>60581172

>>60578215

Its more due to a muslim communist about to be placed in as mayor with his main policy being confiscation of private property.

Anonymous

(ID: NmTNv7T3)

7/4/2025, 3:47:08 PM

No.60581172

[Report]

>>60581103

I've been trying to help yall get rich so you have enough $ to deal with that.

If you took my advice 18 months ago and invested $100,000 in bitcoin (148% gain) and then rolled that into SBSW (135% gain)on January 1st you would now have almost $600,000. That's the power of high IQ and compounding

Anonymous

(ID: wwcHU0fq)

7/4/2025, 4:36:53 PM

No.60581289

[Report]

>>60581468

>>60579696

This is a great book. Anyone who is too young to remember investing prior to 2008 should read this. The main takeaway that I stress is the importance of real-interest rates and how boring investing really is. It's not normal to beat the market, but in this day and age the liquidity sloshing around changes things significantly. It is also a temporary change and all of that liquidity is going to pull out like the tide at some point and all of the money you thought you made in the last 20+ years will slip through your fingers.

The reason this is so is because of leverage. There is so much borrowed money chasing financial assets that when these loans need to be paid back a massive amount of selling will occur, and there will not be anyone large enough to absorb it all. Only the federal reserve will be able to step in and be forced to buy overpriced assets and put all of the monetary losses onto the currency.

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 4:55:04 PM

No.60581338

[Report]

>>60579954

I honestly think that few grasp what Independence Day represents. Or just how badly the enemy of Life miscalculated when establishing it.

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 5:23:00 PM

No.60581418

[Report]

>>60580157

>that is a man…

They/them are no longer human but have fallen and can not be redeemed without repentance.

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 5:38:01 PM

No.60581468

[Report]

>>60581506

>>60581289

Interesting narratives:

>The main takeaway that I stress is the importance of real-interest rates and how boring investing really is. It's not normal to beat the market,

No such thing as "real-interest rates" this is an imaginary construct to leverage imaginary instruments.

>There is so much borrowed money chasing financial assets that when these loans need to be paid back a massive amount of selling will occur, and there will not be anyone large enough to absorb it all.

Interestingly enough the employment of the word "money:" here is to represent the casino's token known as currency inversely so as to substantiate the instrument, thereby initiating the reader into the casino by "belief" or the extention of misdirection into the similacrum of agreement in the lie, then the subtle association of assets and financial instruments are then mixed together for ingestion by "the mark" you know, the one reading this.

>Only the federal reserve will be able to step in and be forced to buy overpriced assets and put all of the monetary losses onto the currency.

After the spell has been cast and the poison ingested, then the serpent emerged and offered the antidote, which in truth was the entire agenda from the very outset of the construction of the lies.

But the truth is, Silver Ends the Fed.

Anonymous

(ID: NmTNv7T3)

7/4/2025, 5:43:48 PM

No.60581494

[Report]

The main takeaway that I stress is the importance of asset classes and how boring investing really is. It's not normal to beat the market, it's normal to lose, and you lose by investing in rocks.

You need to invest in productive assets, not rocks and you end up with 78 times as much money. Good luck frens

Anonymous

(ID: wwcHU0fq)

7/4/2025, 5:46:18 PM

No.60581506

[Report]

>>60581874

>>60581468

There actually is a thing called real rate of interest. Prior to ZIRP when money became essentially free to borrow, money was scarce and banks actually needed your cash on deposit to backstop loans. Because borrowing was expensive, it encouraged savings and lending was used to invest in capital assets that had expected returns higher than the cost to borrow. Nowadays, most lending is used to finance consumption which is a self-defeating setup because it is consuming savings and destroying capital.

>Your other comments

I'm not really sure what you are trying to say.

Anonymous

(ID: G8PVdLnn)

7/4/2025, 5:50:30 PM

No.60581530

[Report]

>>60584475

>>60579450

>>60579473

dragons stack molar weight

Need to sell some silver (generic rounds and bars). Local coin shop offering 95% of spot.

Good deal?

Anonymous

(ID: wT3wv36O)

7/4/2025, 5:57:06 PM

No.60581556

[Report]

>>60581881

happy burger grilling day, fellow /pmg/ bros (but fuck america)

Anonymous

(ID: G8PVdLnn)

7/4/2025, 5:59:43 PM

No.60581568

[Report]

>>60581535

i have the same necklace

Anonymous

(ID: wT3wv36O)

7/4/2025, 6:02:07 PM

No.60581582

[Report]

here's a box of old sterling

Anonymous

(ID: NmTNv7T3)

7/4/2025, 6:06:34 PM

No.60581600

[Report]

>>60581535

Yeah, fact is,you lose when you buy and sell. Long term you only make .5% per year so losing 20% is losing 40 years of expected gains

Anonymous

(ID: NmTNv7T3)

7/4/2025, 6:08:02 PM

No.60581610

[Report]

And it's worse than that you get taxed 35% on phantom gains (inflation) silver is a shit investment marketed to scared idiots

Anonymous

(ID: a6xNRFjS)

7/4/2025, 6:15:20 PM

No.60581641

[Report]

>>60581938

happy 4th pmg

Anonymous

(ID: Wzc8FiBl)

7/4/2025, 6:35:21 PM

No.60581723

[Report]

>>60577585 (OP)

happy lil gold and silver

Anonymous

(ID: ZIbcdbR2)

7/4/2025, 6:47:30 PM

No.60581770

[Report]

>>60581535

If that's a straight trade for cash it's not bad.

Anonymous

(ID: wT3wv36O)

7/4/2025, 6:51:06 PM

No.60581786

[Report]

>>60581535

why settle for that. shop around and you can get full spot

Anonymous

(ID: a6xNRFjS)

7/4/2025, 6:53:49 PM

No.60581794

[Report]

more good releases?

Anonymous

(ID: LS+GoTWv)

7/4/2025, 7:06:37 PM

No.60581826

[Report]

>>60581933

Posting gold my favorite pocket piece

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 7:22:40 PM

No.60581874

[Report]

>>60582031

>>60581506

>There actually is a thing called real rate of interest.

Only in the context of currency creation, which in and of itself is a lie. The rest should make more sense now.

https://youtu.be/hdyqwVEvyfY

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 7:24:10 PM

No.60581881

[Report]

>>60582092

>>60581556

>happy burger grilling day, fellow /pmg/ bros (but fuck america)

You misspelled butt-fuck.

And we refer to it as independence day, the "original"

Anonymous

(ID: a6xNRFjS)

7/4/2025, 7:35:17 PM

No.60581910

[Report]

couple spot deals starting to pop up

Anonymous

(ID: ygFgER8L)

7/4/2025, 7:38:50 PM

No.60581922

[Report]

>>60579520

too many

>>60579541

Thanks, they average around 10x melt

Anonymous

(ID: vT3xTEh+)

7/4/2025, 7:43:35 PM

No.60581933

[Report]

>>60581826

Is that diarrhea and bacon?

Anonymous

(ID: weWIINp0)

7/4/2025, 7:44:57 PM

No.60581938

[Report]

Anonymous

(ID: wwcHU0fq)

7/4/2025, 8:23:19 PM

No.60582031

[Report]

>>60582135

>>60581874

I disagree completely. Savings is supposed be scarce and utilizing that savings needs to come at a cost. This prevents the misallocation of resources such as financing consumer spending instead of capital investment. Our economy was hollowed out and this was enabled with the expansion of credit. That was a function of interest rates and it brought us to this point of wild, rampant speculation and unsustainable government spending.

It's going to end in a financial calamity because the real-world economy can't just be ignored forever. If no one is saving then where is all of this stuff coming from? How can the government spend trillions on a military and wars only to turn around and repay you plus interest? It doesn't make a lick of sense. And therein lies the ruin of tinkering with the rate of interest to be financial expedient to a broke banking system and a broke government.

None of this would have happened if not for ZIRP.

Anonymous

(ID: /M2h5fvg)

7/4/2025, 8:33:22 PM

No.60582063

[Report]

>>60582853

imagine not stacking meme metals in 2025

Anonymous

(ID: AKfSWCvv)

7/4/2025, 8:44:09 PM

No.60582092

[Report]

>>60582151

>>60581881

More accurately, Secession Day. Tom Jefferson on the lower left

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 8:57:10 PM

No.60582135

[Report]

>>60582214

>>60582226

>>60582031

>I disagree completely.

Only because you have taken "interest" on "credit" and, therefore, are a convert and a believer.

>Savings is supposed be scarce and utilizing that savings needs to come at a cost.

It did, and the price has been paid.

>This prevents the misallocation of resources such as financing consumer spending instead of capital investment.

Capital is nourished by consumption. It's symbiotic, not exclusive.

>Our economy was hollowed out and this was enabled with the expansion of credit. That was a function of interest rates and it brought us to this point of wild, rampant speculation and unsustainable government spending.

Maybe, maybe not. Some don't believe in instruments being able to substantiate demands, demands are met by supplies and suppliers, goods and services by and for the people. You assert that the economy has been hollowed out, to which I can not agree or disagree because I do not fully subscribe to or believe in instruments of representative value, but instead I accept that which is real is true, and that which is true is also real. Meaning: if there's a need, it shall be met. Supply/demand. Not if there's a desire, it shall be fulfilled debt/credit.

>It's going to end in a financial calamity because the real-world economy can't just be ignored forever. If no one is saving then where is all of this stuff coming from? How can the government spend trillions on a military and wars only to turn around and repay you plus interest?

On this, we agree, however, from different perspectives. You have chosen to view the economy from the perspective that the government has programmed into you, that debt exists only through the medium of the instruments they either create (FRN's) or that they sanction to be used (anything tied to FRN's) I on the other hand don't calculate valuation through FRN's exclusively but choose to take "interest" in the people as wherein the inherent value exists, regardless of the imaginary unit's of account.

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 9:01:03 PM

No.60582151

[Report]

>>60582232

>>60582092

>More accurately, Secession Day.

No. Independence is still an active and ongoing practice even now, today, from the enemies within as well as without.

>Tom Jefferson on the lower left

Only an "image" of the legend.

An echo of the spirit to renegotiate that lives on.

Anonymous

(ID: 5q+s3Wme)

7/4/2025, 9:13:36 PM

No.60582183

[Report]

Sup fags

It's been a minute

What's new

Happy 4th

Fuck the king

Fuck the queen

https://m.youtube.com/watch?v=91rHFP0OtTE

Anonymous

(ID: 2+qbHCHj)

7/4/2025, 9:14:35 PM

No.60582190

[Report]

Anonymous

(ID: wwcHU0fq)

7/4/2025, 9:22:51 PM

No.60582214

[Report]

>>60582226

>>60582347

>>60582135

This is a bunch of gobbledegook.

There is no mechanism that can allow an economy to grow without savings. The current system thrives as it does using foreign savings to finance consumption. If we were to scale things down and localize them, you would almost come to the conclusion that the quickest way to get off of a desert island would be not to build shelter and find water, but to build a central bank. It's not good enough to say "people demand" Papa Johns pizzas on a desert island and therefore it magically happens. You need all of the ingredients, labor and capital to first make the pizza. Trying to set up shop and taking payment in seashells will never allow you to continue operations. The surplus always comes first and that surplus, no matter how it is stored, is called savings. In our current economy, if savings rates are 0% then people have no reason to defer consumption and ALL productive effort is actively consumed with nothing left over for investment and depreciation of your infrastructure. I think real rates of interest change business and investing and consumption decisions and keep them sustainable in the long term. Trying to hide economic losses by raising asset prices is the GOAL of lowering interest rates and that has negative impacts on the real economy. I'm not even sure what kind archaic angle you are hinting at but unfortunately I am not really gleening whatever message you are trying to get across.

Anonymous

(ID: 5q+s3Wme)

7/4/2025, 9:28:17 PM

No.60582226

[Report]

Anonymous

(ID: bJajBpih)

7/4/2025, 9:31:22 PM

No.60582232

[Report]

>>60582151

>from the enemies within

That changed yesterday tho

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 10:04:22 PM

No.60582347

[Report]

>>60582360

>>60582214

>This is a bunch of gobbledegook.

>There is no mechanism that can allow an economy to grow without savings.

It's called force, or will, better known as Testament. However, it is usually expressed in this realm as violence.

Anonymous

(ID: wwcHU0fq)

7/4/2025, 10:07:11 PM

No.60582360

[Report]

>>60582611

Anonymous

(ID: NmTNv7T3)

7/4/2025, 10:19:11 PM

No.60582396

[Report]

>>60582431

>>60582437

>>60582617

Take the loss on all your silver and gold and frog rounds and get a third job, whatever it takes, buy 1 or more bitcoin and become ELITE

Anonymous

(ID: wwcHU0fq)

7/4/2025, 10:30:49 PM

No.60582431

[Report]

>>60582510

>>60582396

Scarcity alone is not high quality enough to survive the economic losses are leveraged financial system have to endure. We won't be releveraging up the economy afterwards either, it will be a complete implosion as leverage and debts are yanked out of the system through bankruptcy. People will be crying, completely desperate as their portfolios full of bonds no longer buy anything. Their house value will implode along with their retirement. Benefits will dry up as tax revenues implode. Your insurance won't cover your economic losses to your health and auto.

As people's economic losses mount, people will find their ability to pay for luxury items, collectibles, art etc will all collapse. It will be revealed that it was leverage propping up the price of BTC, and NOT fundamentals. Banks will desperately need to revalue precious metals and international trade and commodity prices will be renegotiated to account for these losses. Bitcoin will look just as foolish as any worthless IOU. They will be find a lot of commonality with the rest of the unsophisticated tax cattle who "did everything right", only to find out that it all boiled down to one thing: If you don't hold it, you don't own it.

Anonymous

(ID: IQ7/xRdd)

7/4/2025, 10:31:39 PM

No.60582437

[Report]

>>60582510

>>60582516

>>60582396

nobody wants something that's so rare nobody can have it.

in fact the more rare something is, the less likely people are to want it. There's a sweet spot where something is common enough that people want it, but rare enough to raise the price. If you had to buy bitcoin by the full coin, nobody would want it. Just like if you had to buy gold by the kilo, nobody would want it.

You're not smart enough to understand this, just like you don't understand how bitcoin works.

Anonymous

(ID: 0z/Zt8CW)

7/4/2025, 10:45:33 PM

No.60582476

[Report]

>>60582481

so the silver I bought 5 years ago or something has now made 50% in profit

if I would have been a richfag I would have made it even more, but all I can do now is seethe at my 5 figure profit

Anonymous

(ID: IQ7/xRdd)

7/4/2025, 10:47:16 PM

No.60582481

[Report]

>>60582476

It's only profit if you sell

Anonymous

(ID: NmTNv7T3)

7/4/2025, 10:55:49 PM

No.60582510

[Report]

>>60582522

>>60582537

>>60582437

>nobody wants bitcoin

Lmao that's your best argument?

>>60582431

This is why silver is a terrible investment everyone will be broke and all the poors will sell their 4 ounces for $6 just to buy a mcchicken

Anonymous

(ID: wwcHU0fq)

7/4/2025, 10:57:14 PM

No.60582516

[Report]

>>60582537

>>60582437

The general populace never trust banks for the rest of their lives after the Great Depression. I think trying to buy something with crypto is just not going to make sense when they see the price of money-metals run away along with other commodities. If bank deposits, bank credit, and government debts all take a massive haircut, on what ground would something like crypto maintain any purchasing power?

Anonymous

(ID: wwcHU0fq)

7/4/2025, 10:58:59 PM

No.60582522

[Report]

>>60582564

>>60582738

>>60588064

>>60582510

Banks recapitalize themselves by revaluing gold. Silver and gold will steal all of the worlds purchasing power when people cease taking bank credit for payment.

Anonymous

(ID: IQ7/xRdd)

7/4/2025, 11:04:20 PM

No.60582537

[Report]

>>60582510

>Lmao that's your best argument?

it's true and you know it or you wouldn't spend all day every day trying to get people to buy it.

>>60582516

the number of cases where crypto goes to zero are infinite

there's only one possible case where crypto retains value, and that's stasis. Things have to stay exactly like they are right now for crypto to remain valuable.

Anonymous

(ID: NmTNv7T3)

7/4/2025, 11:16:02 PM

No.60582564

[Report]

>>60582587

>>60582522

Banks don't own gold fren maybe jp morgan will recapitalize by revaluing bitcoin to $2 million since you believe banks control asset prices

Anonymous

(ID: wwcHU0fq)

7/4/2025, 11:27:24 PM

No.60582587

[Report]

>>60582594

>>60582564

>Central banks don't own gold

Anonymous

(ID: NmTNv7T3)

7/4/2025, 11:31:15 PM

No.60582594

[Report]

>>60582599

>>60582587

Nah they just print more money and send bitcoin to $2 million

Anonymous

(ID: IQ7/xRdd)

7/4/2025, 11:32:42 PM

No.60582599

[Report]

>>60582622

>>60582657

>>60582594

If you're lucky.

Bitcoin is technology, and technology will either become outdated quickly or collapse. It's not going to stay the same forever.

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 11:41:12 PM

No.60582611

[Report]

>>60582647

>>60582360

Read it and weep

Silver Separatist

(ID: 8W4QTl/L)

7/4/2025, 11:42:44 PM

No.60582617

[Report]

>>60582635

>>60582396

And 0% can ever hold one

Keked

Anonymous

(ID: NmTNv7T3)

7/4/2025, 11:43:59 PM

No.60582622

[Report]

>>60582599

The smartest and richest people are buying bitcoin, the dumbest and poorest buy silver,,,,it's not complicated yall the product of millions of YouTube ads and fearporn blogs

Anonymous

(ID: NmTNv7T3)

7/4/2025, 11:49:01 PM

No.60582635

[Report]

>>60582695

>>60582851

>>60582617

Kektop, you posted this picture showing you fell for the SETF scam and you can't even spell your own Name where you larp as a freedom fighter. I'm siding with the rich smart people who buy bitcoin

Anonymous

(ID: z334IIPE)

7/4/2025, 11:49:43 PM

No.60582637

[Report]

>>AKfSWCvv

Excellent coins:)

Anonymous

(ID: a6xNRFjS)

7/4/2025, 11:51:46 PM

No.60582647

[Report]

>>60582611

huh, treefren? that would be fun

Anonymous

(ID: j9dw3MVR)

7/4/2025, 11:56:21 PM

No.60582657

[Report]

>>60582599

Imagine being 1 solar storm away from losing absofuckinglutely everything forever. Top kek

Robots will never replace us. They are simply more reliable for kikes than pavement apes. Simple as.

Anonymous

(ID: a6xNRFjS)

7/5/2025, 12:09:51 AM

No.60582695

[Report]

>>60582743

>>60582755

>>60582635

that isn't silver nigger

Anonymous

(ID: ZIbcdbR2)

7/5/2025, 12:29:59 AM

No.60582738

[Report]

>>60582742

>>60583310

>>60583512

>>60582522

Banks revaluing gold doesn't make the value of your gold go up other than as a byproduct of the inflation they produce by being able to loan more fiat because the gold on their balance sheet is 'worth more' for accounting purposes.

Idk why so many people have trouble with this concept.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 12:34:25 AM

No.60582742

[Report]

>>60582746

>>60582747

>>60582759

>>60582738

>Idk why so many people have trouble with this concept.

probably because gold outpaced inflation by 9x since 1975, meaning its value has gone up in real terms, not just because of inflation of the money supply.

Silver Separatist

(ID: 8W4QTl/L)

7/5/2025, 12:35:23 AM

No.60582743

[Report]

>>60582695

They/them wouldn't know what to do with real money if they/them had it anyway.

As the picture is relative to the suitability of the pool, the one you're responding to doesn't belong in ours, and that's why they're not.

Gene pool, that is.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 12:36:37 AM

No.60582746

[Report]

>>60582742

>because gold outpaced inflation by 9x since 1975,

oops, outdated numbers

gold has now outpaced inflation by 16x since 1975

Anonymous

(ID: ZIbcdbR2)

7/5/2025, 12:37:12 AM

No.60582747

[Report]

>>60582756

>>60582742

That doesn't change the number in the ledger though.

Anonymous

(ID: NmTNv7T3)

7/5/2025, 12:40:54 AM

No.60582755

[Report]

>>60583302

>>60582695

"Silver separatist" seems like a FED, maybe they replaced him because he couldn't spell it wouldn’t surprise me if he is posting fake silver the Feds would have a large supply of that.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 12:41:36 AM

No.60582756

[Report]

>>60582791

>>60582747

it does as long as it continues to gain value 16 times faster than they can print money.

in fact the act of printing money increases gold's value beyond the amount printed because it forces people to flee dollars and buy gold and other assets.

Anonymous

(ID: NmTNv7T3)

7/5/2025, 12:42:39 AM

No.60582759

[Report]

>>60582765

>>60582816

>>60582742

>gold outpaced inflation by 0x since 1980

Terrible investment

Anonymous

(ID: 8vSBhj6b)

7/5/2025, 12:47:22 AM

No.60582765

[Report]

>>60582770

>>60582759

>don't critisize my bars of metal, I may get violent

Anonymous

(ID: NmTNv7T3)

7/5/2025, 12:52:21 AM

No.60582770

[Report]

>>60582765

They claim gold and silver always goes up but silver is down 70% inflation adjusted since 1980 and gold is flat

Anonymous

(ID: ukkfrlcT)

7/5/2025, 12:57:02 AM

No.60582782

[Report]

Anonymous

(ID: ZIbcdbR2)

7/5/2025, 1:01:38 AM

No.60582791

[Report]

>>60582800

>>60582756

It quite literally doesn't. They wrote the value of gold for their margin calculation at $35/oz or whatever and that number doesn't change until they feel like changing it or the fiat value of gold somehow gets near $35 again and they're forced to change it.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 1:07:16 AM

No.60582800

[Report]

>>60582821

>>60582791

the number they write down doesn't set the value of gold.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 1:11:49 AM

No.60582816

[Report]

>>60582836

>>60582759

bitcoin is a terrible investment if you bought it 2 days ago.

everyone ignores your cherry picking because even retards can see what you're doing.

Anonymous

(ID: ZIbcdbR2)

7/5/2025, 1:16:28 AM

No.60582821

[Report]

>>60582834

>>60582800

No, but neither does the spot price of gold.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 1:24:17 AM

No.60582834

[Report]

>>60582821

True. I'd guess it's closer than what they're writing though.

Anonymous

(ID: NmTNv7T3)

7/5/2025, 1:25:13 AM

No.60582836

[Report]

>>60582843

>>60582816

Gold has 0% return after inflation in 45 years, and if you sold gold you bought in 1980 you would pay a huge tax. Inconvenient facts for coin merchants

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 1:28:12 AM

No.60582843

[Report]

>>60582836

Bitcoin is down 3% if you bought it you lost money and don't owe taxes because you don't owe taxes on lost money.

Anonymous

(ID: hDXg0Emy)

7/5/2025, 1:33:08 AM

No.60582851

[Report]

>>60582962

>>60582635

why are you stalking him?

Anonymous

(ID: 4f/Vs7MW)

7/5/2025, 1:34:38 AM

No.60582853

[Report]

>>60582063

Based beyond belief

Anonymous

(ID: hDXg0Emy)

7/5/2025, 1:47:34 AM

No.60582879

[Report]

>>60582971

wtf did they not tamp the price today??

Anonymous

(ID: NmTNv7T3)

7/5/2025, 2:26:16 AM

No.60582962

[Report]

>>60582970

>>60582851

Seems kind of weird that he names himself "silver separatist " like a FED, and even more bizarre he forgets the spelling of his weird name

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 2:28:42 AM

No.60582970

[Report]

>>60582962

You know a lot of feds, do ya?

Anonymous

(ID: NmTNv7T3)

7/5/2025, 2:29:44 AM

No.60582971

[Report]

>>60583088

>>60582879

Oh you fell for the "powerful people control the price of silver scam"

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 3:18:00 AM

No.60583088

[Report]

>>60582971

powerful people certainly control the price of silver. And gold too.

without rich people buying the shit out of it, it would be worth a tenth of what it is right now. Well, not gold. Gold would drop by a factor of 1000.

Anonymous

(ID: jUosqwFt)

7/5/2025, 3:26:10 AM

No.60583108

[Report]

>>60583115

Can we talk about investing in rare-earth elements in here too?

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 3:31:33 AM

No.60583115

[Report]

>>60583108

sure but I've never seen them for sale or seen anyone trying to buy them aside from lab samples and gemstones.

Anonymous

(ID: TkoWD6Uq)

7/5/2025, 3:43:32 AM

No.60583151

[Report]

think about it like this: you would give anything in time to go back a few years when you could get a 10 oz for 200. now youre complaining about paying over 350 for a oz. what is it going to feel like when you have to pay half a thousand for a 10 oz bar?

Silver Separatist

(ID: 8W4QTl/L)

7/5/2025, 4:47:40 AM

No.60583302

[Report]

>>60582755

You seem like....

Hmmmm....

I think there's a documentary somewhere around here...

Oh yeah.

https://odysee.com/@Anonymous:d16/Codex-Pajeet-3:d0

Silver Separatist

(ID: 8W4QTl/L)

7/5/2025, 4:51:17 AM

No.60583310

[Report]

>>60582738

>Idk why so many people have trouble with this concept.

Don't forget the exponentially increases in population, while scarcity of resources remains linearly scarce...

Anonymous

(ID: /M2h5fvg)

7/5/2025, 5:08:21 AM

No.60583345

[Report]

>>60583492

friendly reminder wagmi

hope every had/is having a great 4th

just an observation - currently the ratios of au-ag and ag-cu are fairly close to 1-100

not sure if that means anything special

Silver Separatist

(ID: 8W4QTl/L)

7/5/2025, 6:02:41 AM

No.60583492

[Report]

>>60583345

>friendly reminder wagmi

Hopefully, even the pedojeets pivot into classical, tangible monies to make it with us, and stop touching women without permission, maybe even take a personal hygiene class or something.

>hope every had/is having a great 4th

I am/have, and hope everyone else realizes just how blessed to either be in America or in the American favor they are.

>just an observation - currently the ratios of au-ag and ag-cu are fairly close to 1-100

>not sure if that means anything special

If this ratio remains within 5 points in relative comparison for longer than a year, I would become extremely hopeful and confident that a pegging has occurred behind the scenes by national interests and banking cartels. I would become extremely suspicious if it lasts longer than a year after Trump's term. My personal opinion would be that BRICS is responsible and is fully determined to successfully become the next world's reserve currency on that specific ratio spread on a tri-metalistic standard. I say this from the American perspective, of course, because we should have pioneerd this internally, as well as digitally with redeemability through our treasury.

I personally feel that Bitcoin is being introduced so blatantly and obviously by glowing alphabet bois as a deflationary sponge of currency creation was a foolhardy risk that shouldn't have been taken. It will be the final financial straw that destroys the greatest civilization ever to exist.

The main reason I ever even speak is because I honestly want the same freedoms, liberties, and justice that I have come to be so thankful for for everyone who exists.

Happy independence day, everyone!

Anonymous

(ID: wwcHU0fq)

7/5/2025, 6:12:38 AM

No.60583512

[Report]

>>60583598

>>60582738

So in 1933, gold moving from $20.67 to $35 was meaningless? I don't think so. Those who had the gold benefited on the devaluation of the cash in very real terms. Example: They went from having 5 ounces of gold in the bank to 2.95.

That's what happens when you store your purchasing power in credit. You work your life away putting 5 ounces of gold in the system and when it comes time to retire you only get 3 ounces back out. Keeping the real-value protects you from the theft.

Anonymous

(ID: MEOUgJHG)

7/5/2025, 6:21:47 AM

No.60583537

[Report]

>>60583557

>>60578809

Lmfao so many wins from bitchcoin and yet measured against gold, crypto is down ten percent plus from its all time high factoring in inflation as well. That means desire the bitch coin reserve, despite wall Street getting involved, despite the scam spreading and entire countries like el Salvador making a loss on bitcoin, despite all that shit bitcoin continues to crash in real term value against gold.

That means the whales are selling to bag holders. These cryptards will hold for another ten years screaming about bitch coin going to a million without understanding everything else went up in nominal price as well at a much faster rate. Essentially these retards are bragging that they're going to be Zimbabwe billionaires lmfao.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 6:29:41 AM

No.60583557

[Report]

>>60583573

>>60583537

>these retards are bragging that they're going to be Zimbabwe billionaires lmfao.

It's bound to happen

when I was a kid one in 2000 americans were millionaires. Now one in 5 americans are millionaires. People aren't wealthier now, the dollar is just relatively worthless.

Anonymous

(ID: wT3wv36O)

7/5/2025, 6:36:35 AM

No.60583573

[Report]

>>60583584

>>60583557

No, 1 in 5 Americans are not millionaires. While the number of millionaires in the U.S. has been increasing, it's more accurate to say that roughly one in fifteen Americans are millionaires. This translates to about 22 million people in the U.S. with a net worth of over $1 million, according to a UBS report.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 6:39:14 AM

No.60583584

[Report]

>>60583589

>>60583573

incorrect. You're mixing up HOUSEHOLDS with people.

>Approximately 17.76% of American households are considered millionaires, according to a Quora article citing Credit Suisse data. This translates to roughly 22 million households, according to Yahoo Finance. The calculation includes the value of real estate and businesses alongside financial assets.

Anonymous

(ID: wT3wv36O)

7/5/2025, 6:41:38 AM

No.60583589

[Report]

>>60583591

>>60583611

>>60583584

um, pretty sure it's you who is mixing up households with people

>Now one in 5 americans are millionaires.

this is incorrect

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 6:42:39 AM

No.60583591

[Report]

>>60583589

22mm PEOPLE is ~7% of americans

22mm HOUSEHOLDS is ~18% of americans

Anonymous

(ID: ZIbcdbR2)

7/5/2025, 6:45:29 AM

No.60583598

[Report]

>>60584377

>>60583512

Irrelevant in the modern context because there's no gold peg since 73. There's no promise to deliver gold at balance sheet price.

Anonymous

(ID: IQ7/xRdd)

7/5/2025, 6:58:55 AM

No.60583611

[Report]

>>60583693

>>60583589

Either way you count it, when I was a kid there were about 500 millionaires in the US. Now by the lowest count there's 22,000,000.

by an extremely conservative count there's 44,000 times more millionaires now while the population has gone up only 2 times. Making millionaires something like 22,000 times more common than when I was young.

being a millionaire now means almost nothing. Billionaire is literally the new millionaire. By the time people here are old, everyone will be millionaires and the dollar will be worth so little people will drop them on the street and not bother to pick them up.

Anonymous

(ID: wT3wv36O)

7/5/2025, 7:39:42 AM

No.60583693

[Report]

>>60584362

>>60583611

nah we're gonna see a massive deflationary event

Anonymous

(ID: 3MQObyfI)

7/5/2025, 9:32:10 AM

No.60583871

[Report]

>>60578242

because this is all kiked insider coordinated globalist banker faggotry for the great reset

Anonymous

(ID: NmTNv7T3)

7/5/2025, 9:44:47 AM

No.60583878

[Report]

>>60583884

It takes $billions in advertising to convince dumb people that rocks are a good investment,,,,,,,

Anonymous

(ID: +oUAaPos)

7/5/2025, 9:49:30 AM

No.60583884

[Report]

>>60584278

>>60583878

ah, at least its better than wasting your money. right guys?

Anonymous

(ID: y9IlHvkW)

7/5/2025, 12:02:15 PM

No.60584024

[Report]

>>60584058

>>60585180

Silver is going to get slammed by this big beautiful bill huh

Anonymous

(ID: Y6Oml8IL)

7/5/2025, 12:24:54 PM

No.60584058

[Report]

>>60584024

Very cool image.

Anonymous

(ID: NmTNv7T3)

7/5/2025, 2:41:35 PM

No.60584278

[Report]

>>60583884

It is worse than wasting your money it's wasting your life. Work, buy rocks repeat until you die. Lmao that's what $billions of advertising convinced pmg to do. Zero payoff except coin merchants get rich

Anonymous

(ID: AKfSWCvv)

7/5/2025, 3:38:33 PM

No.60584362

[Report]

>>60583693

Not likely as long as the government can create dollars. Yes, the debt bubble will pop and a huge sinkhole will open up but the government will pour dollars into it as fast as possible. Remember, the US government is not limited to borrowing dollars from the Fed. It can print money too. And if it can't borrow it will print. That's when hyperinflation will be unleashed.

Anonymous

(ID: wwcHU0fq)

7/5/2025, 3:51:43 PM

No.60584377

[Report]

>>60584395

>>60584396

>>60583598

They can just repeg the dollar at a much higher level to instill confidence in the financial system. Simple, really.

Anonymous

(ID: NmTNv7T3)

7/5/2025, 4:03:50 PM

No.60584395

[Report]

>>60584433

>>60584377

No one wants a gold standard. People are free to pay in gold and NOONE does

Anonymous

(ID: ZIbcdbR2)

7/5/2025, 4:04:17 PM

No.60584396

[Report]

>>60584433

>>60584377

They could but the two aren't linked at all. I guarantee the first time they revalue gold they won't be introducing a dollar peg because that's another way they'll be able to lend more fiat. If they ever do peg dollar to gold again, the price of your gold in dollar terms will only go down.

Anonymous

(ID: wwcHU0fq)

7/5/2025, 4:27:49 PM

No.60584433

[Report]

>>60584455

>>60584395

Central banks seem to care about gold. I think their needs are what matters more than you and I.

>>60584396

I think the rest of the world is sick of the dollar system given that American will implode if they can't spend print and spend $2TN into the economy. The dollars value is needed to maintain the status quo, but everyone can see that these dollars aren't really good reserves to have on your balance sheet.

>The price of the gold will go down

That's interesting because that would make the bond market even more burdensome to the global economy and not actually alleviate any of the resource shortages. That won't happen.

Anonymous

(ID: NmTNv7T3)

7/5/2025, 4:34:37 PM

No.60584455

[Report]

>>60584949

>>60584433

>Central banks seem to care about gold.

Not the only one that matters

Anonymous

(ID: NmTNv7T3)

7/5/2025, 4:36:10 PM

No.60584459

[Report]

>>60584463

Any country can have a gold standard,,,,,none does

Any individual or company can use the gold standard,,,,,,none do

Lmao but go ahead waste your life waiting

Anonymous

(ID: wwcHU0fq)

7/5/2025, 4:39:17 PM

No.60584463

[Report]

>>60584621

>>60584459

>Any country can have a gold standard,,,,,none does

They don't because the dollar reserve system compels them to actively manage the exchange rates of their currencies. Now that the dollar has been compromised over the decades, it is not as desired as it once was. Most of the world hates America too, so they would happily step away from the dollar and reduce america's standing on the global stage.

Anonymous

(ID: LLyEMa3g)

7/5/2025, 4:44:29 PM

No.60584475

[Report]

>>60581530

So like, teeth?

Anonymous

(ID: LS+GoTWv)

7/5/2025, 5:50:16 PM

No.60584621

[Report]

>>60585298

>>60584463

>Now that the dollar has been compromised over the decades, it is not as desired as it once was. Most of the world hates America too, so

Is that what coin merchants ads told you?

Anonymous

(ID: ukkfrlcT)

7/5/2025, 6:55:03 PM

No.60584778

[Report]

Christ is king. God bless all of you!!!

Anonymous

(ID: TkoWD6Uq)

7/5/2025, 7:00:09 PM

No.60584787

[Report]

>>60584793

>>60584865

>>60585978

Will we see sub 35/oz silver again by the end of the year?

Anonymous

(ID: ukkfrlcT)

7/5/2025, 7:02:33 PM

No.60584793

[Report]

>>60584787

Probably not, and if so, not for very long. It hit 29 bucks for half a day recently, nobody had time to slurp that.

Anonymous

(ID: ukkfrlcT)

7/5/2025, 7:03:42 PM

No.60584798

[Report]

Anonymous

(ID: NmTNv7T3)

7/5/2025, 7:31:41 PM

No.60584865

[Report]

>>60584787

Silver is never going up there's at least 50 billion ounces already mined and sitting in piles in dumb peoples closets. And the glut gets bigger every year

Anonymous

(ID: MGiD4jfS)

7/5/2025, 7:36:13 PM

No.60584878

[Report]

>>60585180

>>60585230

Why don't we invest in mining stocks and get bitcoin-like returns?

Anonymous

(ID: XK2+QJp9)

7/5/2025, 8:00:29 PM

No.60584949

[Report]

>>60584455

>Not the only one that matters

Epstein's banker has hedged against the other global banks gold reserves with silver. You either have no fucking idea what you're talking about or you're posting from a gay bar in tel aviv that's about to be flattened anyways.

Anonymous

(ID: pO8/3Ujs)

7/5/2025, 8:17:19 PM

No.60585007

[Report]

>>60585139

Thoughts on palladium? Are there any palladium investors on /biz/?

Looks like it has finally bottomed and could easily x2 from here.

Anonymous

(ID: +/rvZI5c)

7/5/2025, 8:38:44 PM

No.60585069

[Report]

We're getting close to $40, bros. Not sure why gold couldn't keep up being at $3400

Anonymous

(ID: NmTNv7T3)

7/5/2025, 9:07:37 PM

No.60585139

[Report]

>>60585190

>>60585007

Just IQELITE, he's made 135% on SBSW this year. Why didn't you listen?

Anonymous

(ID: P9Con3LB)

7/5/2025, 9:19:40 PM

No.60585180

[Report]

>>60585317

>>60584024

Next year, yes. It will easily go back to <20 bucks an ounce.

>>60584878

I wonder why is Traore so popular in African news.

Anonymous

(ID: pO8/3Ujs)

7/5/2025, 9:23:40 PM

No.60585190

[Report]

Anonymous

(ID: a6xNRFjS)

7/5/2025, 9:29:58 PM

No.60585214

[Report]

>>60586079

would these help keep me safe if there is another covid outbreak?

Anonymous

(ID: Wb9cT+kf)

7/5/2025, 9:37:24 PM

No.60585230

[Report]

>>60585304

>>60584878

Don't invest in shithole countries

Problem solved

Anonymous

(ID: 4f/Vs7MW)

7/5/2025, 9:44:20 PM

No.60585243

[Report]

>>60585272

>>60586008

Can someone ask him why he deleted this? Or maybe he can chime in here ;)

Anonymous

(ID: 4f/Vs7MW)

7/5/2025, 9:51:18 PM

No.60585272

[Report]

>>60585594

>>60585243

nvm I found it was hidden in some replies

Anonymous

(ID: wwcHU0fq)

7/5/2025, 9:58:50 PM

No.60585298

[Report]

>>60584621

>No rebuttal.

IQDalit, you are given ample opportunities to actually engage in a counterargument but you don't seem to be able to articulate even the most meager pushback. It's really pathetic.

Anonymous

(ID: NmTNv7T3)

7/5/2025, 10:01:22 PM

No.60585304

[Report]

>>60585230

Terrible advice. I'm getting rich investing in shithole countries. Better advice is dont invest in rocks. Dead assets

Anonymous

(ID: gYp8m76u)

7/5/2025, 10:04:32 PM

No.60585317

[Report]

>>60585180

>It will easily go back to <20 bucks an ounce

FUCK I started buying at like 32. Well I wasn't planning on selling anyways.

Anonymous

(ID: wwcHU0fq)

7/5/2025, 10:04:42 PM

No.60585318

[Report]

>>60585343

I will not be the victim of the fiat fallout

Anonymous

(ID: PY2vHAlx)

7/5/2025, 10:05:02 PM

No.60585320

[Report]

>60585304

that stock is down 70 percent. not buying your bags

Anonymous

(ID: hDXg0Emy)

7/5/2025, 10:11:02 PM

No.60585343

[Report]

>>60585318

i'm just going to be rich from buying silver

Anonymous

(ID: wwcHU0fq)

7/5/2025, 10:35:01 PM

No.60585427

[Report]

>>60585480

>>60585483

6 more ounces arrived in the mail just now. Traded in my worthless fiat for some value-dense commodities. Yea, I'm thinkin I am going to make it. You only need like, 64 ounces to be in the top 20%? 360 to be in the top 1%? Pretty nice knowing I have locked in wealth that will last me the rest of my life and I don't need to concern myself trying to speculate on on credit assets that are in a bubble.

Anonymous

(ID: weWIINp0)

7/5/2025, 10:47:16 PM

No.60585480

[Report]

Anonymous

(ID: hDXg0Emy)

7/5/2025, 10:49:09 PM

No.60585483

[Report]

>>60585427

WAGMI except IQ

Anonymous

(ID: NmTNv7T3)

7/5/2025, 11:01:39 PM

No.60585506

[Report]

>>60585510

>>60585551

Reminder you need 140,000 ounces of silver to make it. You can do it!

Anonymous

(ID: gxW7/xpT)

7/5/2025, 11:02:53 PM

No.60585510

[Report]

>>60585506

Once it drops to 20 an ounce in September I'll probably buy that much.

Anonymous

(ID: zDmKgLEd)

7/5/2025, 11:16:05 PM

No.60585543

[Report]

>>60585553

Anyone else think how wild it is that this fucking faggot has been fagging this place up non stop 24/7 for almost 3 years now?

Crazy to think about and highly fucking suspicious.

Anonymous

(ID: wwcHU0fq)

7/5/2025, 11:18:54 PM

No.60585551

[Report]

>>60585588

>>60585506

The bond market and stock market alone are like $85TN in size. If that money flows into precious metals, the $24BN annual production of silver will evaporate like a drop of water on the sun.

Anonymous

(ID: hDXg0Emy)

7/5/2025, 11:19:57 PM

No.60585553

[Report]

>>60585543

Either it's a bot or it's some 3rd worlder being paid to be here

Not much we can do about it except filter

Anonymous

(ID: NmTNv7T3)

7/5/2025, 11:34:23 PM

No.60585588

[Report]

>>60585652

>>60585551

Bonds pay interest silver doesn't. Silver is a shit investment down 70% inflation adjusted since 1980

Anonymous

(ID: OtbbLoYq)

7/5/2025, 11:37:11 PM

No.60585594

[Report]

Anonymous

(ID: wwcHU0fq)

7/6/2025, 12:03:54 AM

No.60585652

[Report]

>>60585710

>>60585588

And interest is $1TN per year, which is almost half of our tax revenue. We have to print $2TN each year to keep the spending up or risk economic decline.

I wouldn't want to collect interest from a broke entity. The financial system is ruined which is why it is smart to buy valuable materials and get your money out of the paper ponzi.

Anonymous

(ID: NmTNv7T3)

7/6/2025, 12:26:15 AM

No.60585710

[Report]

>>60585793

>>60585652

What's your best reason for why silver is a good investment?

Anonymous

(ID: 4f/Vs7MW)

7/6/2025, 12:53:37 AM

No.60585774

[Report]

>>60585858

Anonymous

(ID: HUrV1QPP)

7/6/2025, 12:58:07 AM

No.60585793

[Report]

>>60585811

>>60585710

It's necessary for the creation of cruise missiles, agzn batteries and torpedoes, also most military equipment globally. It and gold are being sought by BRICS as an alternative to settling trade to the dollar. Both of these traits are things

BTC cannot participate in.

Anonymous

(ID: NmTNv7T3)

7/6/2025, 1:04:31 AM

No.60585811

[Report]

>>60585793

Lmao, that's 2. Usually you list at least 5. You love the laundry list of reasons because none of them are good

Anonymous

(ID: hDXg0Emy)

7/6/2025, 1:09:40 AM

No.60585827

[Report]

Anonymous

(ID: i1I+kUpt)

7/6/2025, 1:21:41 AM

No.60585850

[Report]

>>60585855

Is tax-free silver just a retarded buy if the premium is 20%+?

Anonymous

(ID: NmTNv7T3)

7/6/2025, 1:24:45 AM

No.60585855

[Report]

>>60585990

>>60585850

Yes, remember it's taxed at the highest rate when you sell it

Anonymous

(ID: NmTNv7T3)

7/6/2025, 1:25:55 AM

No.60585858

[Report]

Akso 20% is the expected return until 2065

>>60585774

Anonymous

(ID: z334IIPE)

7/6/2025, 2:12:41 AM

No.60585976

[Report]

>>60586137

>>60586149

>>60586261

German gold:)

Anonymous

(ID: 3MQObyfI)

7/6/2025, 2:13:08 AM

No.60585978

[Report]

>>60584787

yes as soon as theres a liquidity crisis or market drop silver will drop 20%

Anonymous

(ID: z334IIPE)

7/6/2025, 2:14:06 AM

No.60585982

[Report]

Anonymous

(ID: IQ7/xRdd)

7/6/2025, 2:18:17 AM

No.60585990

[Report]

>>60586047

>>60585855

>it's taxed at the highest rate when you sell it

Eagles and other US mint coins aren't taxed anymore. They haven't been taxed since january 1st of this year.

0% tax rate, no matter how much you sell

Silver Separatist

(ID: 8W4QTl/L)

7/6/2025, 2:24:49 AM

No.60586000

[Report]

>>60586097

So many states have already bent the knees to gold and silver legal tender laws that soon tho one's that haven't will be erecting checkpoints to prevent money from fleeing their jurisdictions.

Anonymous

(ID: bHBk/4XB)

7/6/2025, 2:27:23 AM

No.60586004

[Report]

BUYING ROCKS

Anonymous

(ID: 3MQObyfI)

7/6/2025, 2:29:39 AM

No.60586008

[Report]

>>60586148

>>60585243

where do you even store 800k ounces? hes gotta be buying paper right

Anonymous

(ID: NmTNv7T3)

7/6/2025, 2:40:10 AM

No.60586047

[Report]

>>60586054

>>60586349

>>60586422

>>60585990

37% capital gains tax when you sell, even if it's inflation,,,,,guaranteed loss

Anonymous

(ID: IQ7/xRdd)

7/6/2025, 2:43:45 AM

No.60586054

[Report]

>>60586456

>>60586047

0% capital gains on the sale of any legal tender coin in the US

Anonymous

(ID: oPaR038p)

7/6/2025, 2:57:26 AM

No.60586079

[Report]

>>60586112

Anonymous

(ID: 3eZjsdaR)

7/6/2025, 3:00:38 AM

No.60586085

[Report]

>>60586111

>>60586317

Just bought two more tubes of quarters. If the price gets hammered down Sunday night/Monday morning I hope some of you will take advantage of my misfortune and buy. Traffic was a son of a bitch coming back across the bridge from Delaware.

Anonymous

(ID: +/rvZI5c)

7/6/2025, 3:05:20 AM

No.60586097

[Report]

>>60586327

>>60586000

But have you ever tried to buy with silver at a store? To an average cashier a Merc is just a 10 cent dime.

Anonymous

(ID: a6xNRFjS)

7/6/2025, 3:13:01 AM

No.60586107

[Report]

>>60586129

>>60586177

>>60588002

i didn't want to buy more coins

Anonymous

(ID: +/rvZI5c)

7/6/2025, 3:15:25 AM

No.60586111

[Report]

>>60586330

>>60586085

Was it cheaper at the LCS than online?

Anonymous

(ID: a6xNRFjS)

7/6/2025, 3:15:47 AM

No.60586112

[Report]

>>60586079

god i miss him

Anonymous

(ID: p7mcKmhX)

7/6/2025, 3:22:51 AM

No.60586129

[Report]

>>60586131

>>60586107

Nice bathroom token

Anonymous

(ID: a6xNRFjS)