>>520313597

>Not enough hohols left to feed into the woodchipper.

Can't they type additional amounts of them up on a keyboard? I was assured that's how reality works.

4chan Search

27 results for "a1ba297a9fe107e65d92b9404ddb7387"

>>520276909

>I always BTFO him in economics. This is not our first encounter.

It's hilarious that every innumerate cargocult normgroid I btfo feels (not thinks, you don't actually think) the exact same way.

>I always BTFO him in economics. This is not our first encounter.

It's hilarious that every innumerate cargocult normgroid I btfo feels (not thinks, you don't actually think) the exact same way.

>>519810836

>If households have to compete with these corporations for power, we know who'll get power and who'll be left on the dark.

The only way forward is moving past money, banks or capitalism. Then households don't need to compete with datacenters in bidding for electricity. And most of the population wouldn't be getting pauperised constantly, continuously.

>If households have to compete with these corporations for power, we know who'll get power and who'll be left on the dark.

The only way forward is moving past money, banks or capitalism. Then households don't need to compete with datacenters in bidding for electricity. And most of the population wouldn't be getting pauperised constantly, continuously.

>>519281672

There are 2 types of fiat currency:

1. Physical cash and coins printed, minted or coined by the central banks (or for them by private businesses under exclusivity contracts with the central banks).

2. Money of account. This is fictional cash and coins which don't exist physically and are just promises to pay cash or coins, in the same nominal amount, to the holder, on demand. They exist on the ledgers of the banking system.

Banks have been granted the right to "legally" deceive the entirety of society that the second type of fiat currency is the same as the first or that it doesn't exist, with the implication being that the second type of fiat currency is actually the first type when it really isn't. The proof that these two are not the same type of fiat currency, and also the proof that there is *A LOT* more of the second type in existence than the first, is that banks can run out of the first type of fiat currency to honour "withdrawal" requests against the second type, by depositors who think they're the same thing, and to avoid that happening, there are laws on the books in every country to force private individuals and businesses to store their physical fiat currency notes and coins, above a meagre amount, in banks and thus only use the second type of fiat currency for their larger transactions. In addition to this, convenience and online purchases ensure that most people prefer the second type of fiat currency.

While only central banks control the creation and issuance into circulation in the economy of the first type of fiat currency, any non-central bank anywhere can issue more of the second type of fiat currency into circulation. They do this by pretending to "lend" the first type of fiat currency to willing borrowers. But in actual fact, they just create more of the second type of fiat currency when they approve the "loan" (which is actually credit and not a loan) and issue it to the borrower. Or a credit card holder pays for something with it.

There are 2 types of fiat currency:

1. Physical cash and coins printed, minted or coined by the central banks (or for them by private businesses under exclusivity contracts with the central banks).

2. Money of account. This is fictional cash and coins which don't exist physically and are just promises to pay cash or coins, in the same nominal amount, to the holder, on demand. They exist on the ledgers of the banking system.

Banks have been granted the right to "legally" deceive the entirety of society that the second type of fiat currency is the same as the first or that it doesn't exist, with the implication being that the second type of fiat currency is actually the first type when it really isn't. The proof that these two are not the same type of fiat currency, and also the proof that there is *A LOT* more of the second type in existence than the first, is that banks can run out of the first type of fiat currency to honour "withdrawal" requests against the second type, by depositors who think they're the same thing, and to avoid that happening, there are laws on the books in every country to force private individuals and businesses to store their physical fiat currency notes and coins, above a meagre amount, in banks and thus only use the second type of fiat currency for their larger transactions. In addition to this, convenience and online purchases ensure that most people prefer the second type of fiat currency.

While only central banks control the creation and issuance into circulation in the economy of the first type of fiat currency, any non-central bank anywhere can issue more of the second type of fiat currency into circulation. They do this by pretending to "lend" the first type of fiat currency to willing borrowers. But in actual fact, they just create more of the second type of fiat currency when they approve the "loan" (which is actually credit and not a loan) and issue it to the borrower. Or a credit card holder pays for something with it.

>>515538034

>The premise isn't true though.

What premise isn't true?

>Commodities are the general input, with (product) transformations being a derivative active.

Wrong. Capitalism does not give one single solitary shit about anything else or other than spendable legal tender, its creation and its circulation. That's it. Everything else is incidental and happens only because actors with reserves or savings of legal tender or the ability to ex nihilo create more legal tender decide that it should happen.

>Money supply can be kept constant without any deleterious effect.

Not in a for-financial-profit operated economy. In such an economy, the money supply has to continue growing geometrically perpetually or you go into a contractionary spiral of the real economy.

>You have grown up in a jew world of jew speculations.

Nigger, I have a geospatial IQ of 140 and I've been thinking about this stuff for literal fucking decades.

I even walked you through the entire mechanism and why it exists and functions the way it does, like someone would a child. Did you even read my post?

>The premise isn't true though.

What premise isn't true?

>Commodities are the general input, with (product) transformations being a derivative active.

Wrong. Capitalism does not give one single solitary shit about anything else or other than spendable legal tender, its creation and its circulation. That's it. Everything else is incidental and happens only because actors with reserves or savings of legal tender or the ability to ex nihilo create more legal tender decide that it should happen.

>Money supply can be kept constant without any deleterious effect.

Not in a for-financial-profit operated economy. In such an economy, the money supply has to continue growing geometrically perpetually or you go into a contractionary spiral of the real economy.

>You have grown up in a jew world of jew speculations.

Nigger, I have a geospatial IQ of 140 and I've been thinking about this stuff for literal fucking decades.

I even walked you through the entire mechanism and why it exists and functions the way it does, like someone would a child. Did you even read my post?

>>513283136

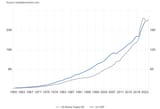

That's some mightily impressive GeeDeePee growth right there.

That's some mightily impressive GeeDeePee growth right there.

>>512683437

Muh (mostly fictional) fiat currency is finite.

Muh (mostly fictional) fiat currency is scarce.

Muh (mostly fictional) fiat currency doesn't grow in availability faster and faster over time.

Muh (mostly fictional) fiat currency is real.

Muh (mostly fictional) fiat currency is wealth.

Muh inflation is wealth creation.

Muh (mostly fictional) fiat currency units moving around is what an economy is.

Paying more for things means I'm richer and more prosperous.

The more I pay, the more I get.

When you spend (mostly fictional) fiat currency units, they immediately disappear out of existence.

As long as I have (mostly fictional) fiat currency, it doesn't matter if there's nothing to spend it on.

Public debt and the inflation caused by borrowing the money to pay for public deficits into existence is of the devil and inflationary but private debt and the inflation caused by borrowing the money to pay for private deficits into existence is from God the Father and absolutely not inflationary.

Banking isn't inherently fraudulent. Only central banks are bad. Any other bank is prefectly fine, good, wholesome and proper.

Muh (mostly fictional) fiat currency is finite.

Muh (mostly fictional) fiat currency is scarce.

Muh (mostly fictional) fiat currency doesn't grow in availability faster and faster over time.

Muh (mostly fictional) fiat currency is real.

Muh (mostly fictional) fiat currency is wealth.

Muh inflation is wealth creation.

Muh (mostly fictional) fiat currency units moving around is what an economy is.

Paying more for things means I'm richer and more prosperous.

The more I pay, the more I get.

When you spend (mostly fictional) fiat currency units, they immediately disappear out of existence.

As long as I have (mostly fictional) fiat currency, it doesn't matter if there's nothing to spend it on.

Public debt and the inflation caused by borrowing the money to pay for public deficits into existence is of the devil and inflationary but private debt and the inflation caused by borrowing the money to pay for private deficits into existence is from God the Father and absolutely not inflationary.

Banking isn't inherently fraudulent. Only central banks are bad. Any other bank is prefectly fine, good, wholesome and proper.

>>512640413

Also, the money supply has to grow not proportional to the amount of stuff but proportional to the amount of stuff available for purchase at any one given moment.

But stuff available for sale gets bought, so becomes unavailable for sale, at least for a while. And so the good/unit which was bought has to be replaced by newly produced good/unit to keep the amount of things available for purchase constant, if the money supply is constant.

So, in actual fact, the money supply size has to be proportional to the total rate of production of various things on which to spend money. Otherwise you have inflation or deflation, as the rate of production of things to buy is not decreases or increases with respect to the money supply.

Of course, there is some degree of self-correction/adjustment through the price mechanism making stuff less affordable and reducing the rate at which they are bought (and therefore the rate at which replacements have to be manufactured) so that they do not run out completely.

But, overall, you want the money supply growth to be proportional to the growth in the amount of stuff being made for the purpose of being sold. Otherwise, if the money supply grows faster, you have inflation.

The problem is that the money for the profits does not actually exist.

Profits are not mathematically possible without:

a) printing the money for them continuously and ever faster.

b) constantly cutting production costs by lowering quality, serving size or moving production to areas with less money (and therefore lower general level of prices and therefore lower production costs as well).

Or some combination of both.

And if foreign currencies intentionally devalue their currency faster than yours, your industry moves to those countries and you become a deindustrialised husk reliant on imports from that industry which relocated abroad, to countries which make sure to keep their currencies weaker than yours. This is what happened to the esteemed western partners.

Also, the money supply has to grow not proportional to the amount of stuff but proportional to the amount of stuff available for purchase at any one given moment.

But stuff available for sale gets bought, so becomes unavailable for sale, at least for a while. And so the good/unit which was bought has to be replaced by newly produced good/unit to keep the amount of things available for purchase constant, if the money supply is constant.

So, in actual fact, the money supply size has to be proportional to the total rate of production of various things on which to spend money. Otherwise you have inflation or deflation, as the rate of production of things to buy is not decreases or increases with respect to the money supply.

Of course, there is some degree of self-correction/adjustment through the price mechanism making stuff less affordable and reducing the rate at which they are bought (and therefore the rate at which replacements have to be manufactured) so that they do not run out completely.

But, overall, you want the money supply growth to be proportional to the growth in the amount of stuff being made for the purpose of being sold. Otherwise, if the money supply grows faster, you have inflation.

The problem is that the money for the profits does not actually exist.

Profits are not mathematically possible without:

a) printing the money for them continuously and ever faster.

b) constantly cutting production costs by lowering quality, serving size or moving production to areas with less money (and therefore lower general level of prices and therefore lower production costs as well).

Or some combination of both.

And if foreign currencies intentionally devalue their currency faster than yours, your industry moves to those countries and you become a deindustrialised husk reliant on imports from that industry which relocated abroad, to countries which make sure to keep their currencies weaker than yours. This is what happened to the esteemed western partners.

>>512551933

>Because the Supply has diminished the demand, thats why.

Look a this retarded moron trying to explain why the US has to import enriched Uranium and can no longer enrich Uranium itself. And also has to import its Tritium. And also has to import pretty much everything else.

His explanation is that supply has diminished demand.

Make it make sense.

LMFAO.

The supply of stuff made domestically in the US has dried up as a result of imports being cheaper. In his mind, this means that supply (of which the US has increasingly little of or none) has diminished demand. Even though imports have grown over time and the price of everything keeps growing continually.

Profound mental retardation.

>When everyone has billions of chickens and rabbits, rabbits and chickens lose their value, how can you miss that glaring obvious factor?

But not everyone has billions of chickens and rabbits, you moron. You don't have enriched Uranium or the capacity to enrich it. You have to import it.

How can it be a problem of oversupply if you have to import it? What if you couldn't import it anymore. What if you hadn't had breakfast this morning?

>read the rest of your retardation

You have no answer as to why perpetual inflation exists if the wealth is continually increasing.

Unless, in your mind:

>Muh (mostly fictional) fiat currency is wealth.

>Muh inflation is wealth creation.

Which seems to be the case with every cargocult idiot.

>kill yourself

You keep trying that even though it obviously isn't working. Why not try paying me instead? Maybe that will work?

>or continue seething at reality

I'm not seething. I'm making fun of golden calf worshippers and entertaining myself using you as props.

>but seriously, why even live when you're so much smarter that literally everyone?

Because I choose to. And I don't live for others, lmfao. I'm not some oversocialized faggot moron cargocultist. I'm an artist, an inventor, a hedonist. I have plenty to live for.

>Pussy faggot retard.

Seethe.

>Because the Supply has diminished the demand, thats why.

Look a this retarded moron trying to explain why the US has to import enriched Uranium and can no longer enrich Uranium itself. And also has to import its Tritium. And also has to import pretty much everything else.

His explanation is that supply has diminished demand.

Make it make sense.

LMFAO.

The supply of stuff made domestically in the US has dried up as a result of imports being cheaper. In his mind, this means that supply (of which the US has increasingly little of or none) has diminished demand. Even though imports have grown over time and the price of everything keeps growing continually.

Profound mental retardation.

>When everyone has billions of chickens and rabbits, rabbits and chickens lose their value, how can you miss that glaring obvious factor?

But not everyone has billions of chickens and rabbits, you moron. You don't have enriched Uranium or the capacity to enrich it. You have to import it.

How can it be a problem of oversupply if you have to import it? What if you couldn't import it anymore. What if you hadn't had breakfast this morning?

>read the rest of your retardation

You have no answer as to why perpetual inflation exists if the wealth is continually increasing.

Unless, in your mind:

>Muh (mostly fictional) fiat currency is wealth.

>Muh inflation is wealth creation.

Which seems to be the case with every cargocult idiot.

>kill yourself

You keep trying that even though it obviously isn't working. Why not try paying me instead? Maybe that will work?

>or continue seething at reality

I'm not seething. I'm making fun of golden calf worshippers and entertaining myself using you as props.

>but seriously, why even live when you're so much smarter that literally everyone?

Because I choose to. And I don't live for others, lmfao. I'm not some oversocialized faggot moron cargocultist. I'm an artist, an inventor, a hedonist. I have plenty to live for.

>Pussy faggot retard.

Seethe.

>>512373418

>I still don't understand how can West0ids take themselves seriously.

They're insane. They have collective insanity. They're cargocultists. Just have to stand out of their way and keep your distance as they destroy themselves. There is no saving them. They will follow their golden calf into the fires of hell.

>Just because an asset decided to for real or artificial reasons to boom

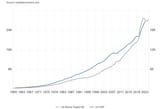

It's always artificial reasons. Pic related.

>does not mean all of the other problems with the economy dissapeared.

They (mostly fictional) fiat currency is wealth and inflation is wealth creation. And that the more they pay for something, the more valuable it is and the more they pay for things, the richer and more prosperous it must mean they are. They think numbers on the screen changing hands is what an economy is.

>Neither is inflation gone

Quite the contrary. The perpetual growth in valuation of the stock market is inflation.

But they think inflation is wealth creation. They are cargocultists.

They are unwell. They have internalised judaism.

>nor have the price of eggs gone down

Of course not. The currency debasement continues apace.

>nor is healthcare affordable in US

LoL, it's not healthcare and people wouldn't even need it if they had actual nutrition and weren't poisoned through their food.

>nor is their infrastructure fixed. Like LMAO

No but they don't care about real things. Capitalism is not about making real things or doing real things. It's about majewic jew numbas on da screen and typing more of them in and moving them around. Nothing else matters to cargocultists, lmao. Not even surviving as a race or species.

>I still don't understand how can West0ids take themselves seriously.

They're insane. They have collective insanity. They're cargocultists. Just have to stand out of their way and keep your distance as they destroy themselves. There is no saving them. They will follow their golden calf into the fires of hell.

>Just because an asset decided to for real or artificial reasons to boom

It's always artificial reasons. Pic related.

>does not mean all of the other problems with the economy dissapeared.

They (mostly fictional) fiat currency is wealth and inflation is wealth creation. And that the more they pay for something, the more valuable it is and the more they pay for things, the richer and more prosperous it must mean they are. They think numbers on the screen changing hands is what an economy is.

>Neither is inflation gone

Quite the contrary. The perpetual growth in valuation of the stock market is inflation.

But they think inflation is wealth creation. They are cargocultists.

They are unwell. They have internalised judaism.

>nor have the price of eggs gone down

Of course not. The currency debasement continues apace.

>nor is healthcare affordable in US

LoL, it's not healthcare and people wouldn't even need it if they had actual nutrition and weren't poisoned through their food.

>nor is their infrastructure fixed. Like LMAO

No but they don't care about real things. Capitalism is not about making real things or doing real things. It's about majewic jew numbas on da screen and typing more of them in and moving them around. Nothing else matters to cargocultists, lmao. Not even surviving as a race or species.

>>60690807

Further increasing the pressure to print more and ever faster is the propensity of a large part of the population and also some corporations and businesses to NOT spend all the fiat currency they receive as wages, dividends, rents, royalties or payments for goods sold or services rendered as soon as they receive said fiat currency. And instead electing to sit on part of their income as fiat currency savings in a bank. Which parks that fiat currency out of circulation, at least for a while, and thus contracts the circulating supply of fiat currency by expanding the parked supply of fiat currency. Which, in turn, makes it necessary for new fiat currency to be created and injected into circulation (by giving it to people and businesses who don't have fiat currency they would nevertheless like to spend and are willing to borrow it from a bank in order to spend it) to replace, in circulation, the fiat currency which has been parked, out of circulation, by people and business who keep at least part of their savings as fiat currency in a bank.

Yet another intrinsic, fundamental, systemic problem of the capitalist model is that fiat currency flows within it are uneven and asymmetric. For example, people pay more to businesses as payment for their goods or services than people receive back from businesses as wages, dividends, rent or royalties. This is because ALL businesses have at least expenses towards other businesses, such as suppliers and subcontractors, utilities companies. This means that people, as a whole and as a class of economic agent, pay more, on average, to businesses, as a whole and as a class of economic agent, than businesses pay back to people as wages, dividends, rent or royalties. The difference has to be perpetually made up from and through consumer credit. Which is people constantly borrowing money to make up the shortfall/discrepancy between what they need to pay for goods and services they need or want and what they themselves are paid.

Further increasing the pressure to print more and ever faster is the propensity of a large part of the population and also some corporations and businesses to NOT spend all the fiat currency they receive as wages, dividends, rents, royalties or payments for goods sold or services rendered as soon as they receive said fiat currency. And instead electing to sit on part of their income as fiat currency savings in a bank. Which parks that fiat currency out of circulation, at least for a while, and thus contracts the circulating supply of fiat currency by expanding the parked supply of fiat currency. Which, in turn, makes it necessary for new fiat currency to be created and injected into circulation (by giving it to people and businesses who don't have fiat currency they would nevertheless like to spend and are willing to borrow it from a bank in order to spend it) to replace, in circulation, the fiat currency which has been parked, out of circulation, by people and business who keep at least part of their savings as fiat currency in a bank.

Yet another intrinsic, fundamental, systemic problem of the capitalist model is that fiat currency flows within it are uneven and asymmetric. For example, people pay more to businesses as payment for their goods or services than people receive back from businesses as wages, dividends, rent or royalties. This is because ALL businesses have at least expenses towards other businesses, such as suppliers and subcontractors, utilities companies. This means that people, as a whole and as a class of economic agent, pay more, on average, to businesses, as a whole and as a class of economic agent, than businesses pay back to people as wages, dividends, rent or royalties. The difference has to be perpetually made up from and through consumer credit. Which is people constantly borrowing money to make up the shortfall/discrepancy between what they need to pay for goods and services they need or want and what they themselves are paid.

>>510458237

The more you pay for things, the richer you are.

Mostly fictional fiat currency is wealth.

Inflation is wealth creation.

The more you pay for things, the richer you are.

Mostly fictional fiat currency is wealth.

Inflation is wealth creation.

>>510314103

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Anyway, going to work. Laterz.

>>509827865

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

>>509738862

>The low low price of half a billion per missile.

The more you pay for things, the richer it must mean you are.

>The low low price of half a billion per missile.

The more you pay for things, the richer it must mean you are.

>>509722322

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

>>509644824

When you go to the bank or the ATM to withdraw cash, you're actually asking to have your fictional cash and coins, which only exist as digits on the digital ledger of your bank, exchanged for physical cash and coins.

Regardless of your opinion on central banks, all non-central banking is legalised fraud because non-central banks issue (create and introduce into circulation) fictional cash and coins by pretending to "lend" it to willing borrowers, who then spend it into the economy, and lying to everyone in society that that fictional cash and coins actually physically exists or is backed by existing physical cash and coins in the same actual amount. Not the case. And this is all somehow ((("legal"))) because jews lying to non-jews and deceiving them and robbing them is perfectly fine as far as jews are concerned.

However, although most banks, in most places, will allow you to exchange your fictional fiat currency notes and coins for physical fiat currency notes and coins, they will put a daily limit on how much of the first type of fiat currency you can exchange for the latter. Or, if you want to exchange large amounts, they'll make you schedule the withdrawal days to weeks in advance. And in some of the most pozzed and jewed jew world order shitholes, which are the 5 eyes countries, banks are starting to outright refuse to allow you to withdraw your cash (actually exchange your fictional cash and coins for physical ones) as steps are being taken to get rid of cash altogether there.

Without cash, bank runs aren't possible because there is no physical cash and coins you can request to have your fictional cash and coins exchanged for when you try and "withdraw" some of your cash you think exists in the bank vault. With bank runs being impossible, every non-central bank becomes its own central bank, with no limit on digital fiat currency creation. Especially combined with de facto or (in the case of the US, de jure since 2020) zero reserve requirements.

When you go to the bank or the ATM to withdraw cash, you're actually asking to have your fictional cash and coins, which only exist as digits on the digital ledger of your bank, exchanged for physical cash and coins.

Regardless of your opinion on central banks, all non-central banking is legalised fraud because non-central banks issue (create and introduce into circulation) fictional cash and coins by pretending to "lend" it to willing borrowers, who then spend it into the economy, and lying to everyone in society that that fictional cash and coins actually physically exists or is backed by existing physical cash and coins in the same actual amount. Not the case. And this is all somehow ((("legal"))) because jews lying to non-jews and deceiving them and robbing them is perfectly fine as far as jews are concerned.

However, although most banks, in most places, will allow you to exchange your fictional fiat currency notes and coins for physical fiat currency notes and coins, they will put a daily limit on how much of the first type of fiat currency you can exchange for the latter. Or, if you want to exchange large amounts, they'll make you schedule the withdrawal days to weeks in advance. And in some of the most pozzed and jewed jew world order shitholes, which are the 5 eyes countries, banks are starting to outright refuse to allow you to withdraw your cash (actually exchange your fictional cash and coins for physical ones) as steps are being taken to get rid of cash altogether there.

Without cash, bank runs aren't possible because there is no physical cash and coins you can request to have your fictional cash and coins exchanged for when you try and "withdraw" some of your cash you think exists in the bank vault. With bank runs being impossible, every non-central bank becomes its own central bank, with no limit on digital fiat currency creation. Especially combined with de facto or (in the case of the US, de jure since 2020) zero reserve requirements.

>>509645387

Further increasing the pressure to print more and ever faster is the propensity of a large part of the population and also some corporations and businesses to NOT spend all the fiat currency they receive as wages, dividends, rents, royalties or payments for goods sold or services rendered as soon as they receive said fiat currency. And instead electing to sit on part of their income as fiat currency savings in a bank. Which parks that fiat currency out of circulation, at least for a while, and thus contracts the circulating supply of fiat currency by expanding the parked supply of fiat currency. Which, in turn, makes it necessary for new fiat currency to be created and injected into circulation (by giving it to people and businesses who don't have fiat currency they would nevertheless like to spend and are willing to borrow it from a bank in order to spend it) to replace, in circulation, the fiat currency which has been parked, out of circulation, by people and business who keep at least part of their savings as fiat currency in a bank.

Yet another intrinsic, fundamental, systemic problem of the capitalist model is that fiat currency flows within it are uneven and asymmetric. For example, people pay more to businesses as payment for their goods or services than people receive back from businesses as wages, dividends, rent or royalties. This is because ALL businesses have at least expenses towards other businesses, such as suppliers and subcontractors, utilities companies. This means that people, as a whole and as a class of economic agent, pay more, on average, to businesses, as a whole and as a class of economic agent, than businesses pay back to people as wages, dividends, rent or royalties. The difference has to be perpetually made up from and through consumer credit. Which is people constantly borrowing money to make up the shortfall/discrepancy between what they need to pay for goods and services they need or want and what they themselves are paid.

Further increasing the pressure to print more and ever faster is the propensity of a large part of the population and also some corporations and businesses to NOT spend all the fiat currency they receive as wages, dividends, rents, royalties or payments for goods sold or services rendered as soon as they receive said fiat currency. And instead electing to sit on part of their income as fiat currency savings in a bank. Which parks that fiat currency out of circulation, at least for a while, and thus contracts the circulating supply of fiat currency by expanding the parked supply of fiat currency. Which, in turn, makes it necessary for new fiat currency to be created and injected into circulation (by giving it to people and businesses who don't have fiat currency they would nevertheless like to spend and are willing to borrow it from a bank in order to spend it) to replace, in circulation, the fiat currency which has been parked, out of circulation, by people and business who keep at least part of their savings as fiat currency in a bank.

Yet another intrinsic, fundamental, systemic problem of the capitalist model is that fiat currency flows within it are uneven and asymmetric. For example, people pay more to businesses as payment for their goods or services than people receive back from businesses as wages, dividends, rent or royalties. This is because ALL businesses have at least expenses towards other businesses, such as suppliers and subcontractors, utilities companies. This means that people, as a whole and as a class of economic agent, pay more, on average, to businesses, as a whole and as a class of economic agent, than businesses pay back to people as wages, dividends, rent or royalties. The difference has to be perpetually made up from and through consumer credit. Which is people constantly borrowing money to make up the shortfall/discrepancy between what they need to pay for goods and services they need or want and what they themselves are paid.

>>509563318

>the American Jews bring shitload of money into the USA

Yeah but you can't eat (mostly fictional) fiat currency. So selling overpriced shit with payment in your own currency is domestically inflationary. Unless the American Jews spend those earnings outside the country as fast they're earned.

>the American Jews bring shitload of money into the USA

Yeah but you can't eat (mostly fictional) fiat currency. So selling overpriced shit with payment in your own currency is domestically inflationary. Unless the American Jews spend those earnings outside the country as fast they're earned.

>>509227716

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

>>509211820

Further increasing the pressure to print more and ever faster is the propensity of a large part of the population and also some corporations and businesses to NOT spend all the fiat currency they receive as wages, dividends, rents, royalties or payments for goods sold or services rendered as soon as they receive said fiat currency. And instead electing to sit on part of their income as fiat currency savings in a bank. Which parks that fiat currency out of circulation, at least for a while, and thus contracts the circulating supply of fiat currency by expanding the parked supply of fiat currency. Which, in turn, makes it necessary for new fiat currency to be created and injected into circulation (by giving it to people and businesses who don't have fiat currency they would nevertheless like to spend and are willing to borrow it from a bank in order to spend it) to replace, in circulation, the fiat currency which has been parked, out of circulation, by people and business who keep at least part of their savings as fiat currency in a bank.

Yet another intrinsic, fundamental, systemic problem of the capitalist model is that fiat currency flows within it are uneven and asymmetric. For example, people pay more to businesses as payment for their goods or services than people receive back from businesses as wages, dividends, rent or royalties. This is because ALL businesses have at least expenses towards other businesses, such as suppliers and subcontractors, utilities companies. This means that people, as a whole and as a class of economic agent, pay more, on average, to businesses, as a whole and as a class of economic agent, than businesses pay back to people as wages, dividends, rent or royalties. The difference has to be perpetually made up from and through consumer credit. Which is people constantly borrowing money to make up the shortfall/discrepancy between what they need to pay for goods and services they need or want and what they themselves are paid.

Further increasing the pressure to print more and ever faster is the propensity of a large part of the population and also some corporations and businesses to NOT spend all the fiat currency they receive as wages, dividends, rents, royalties or payments for goods sold or services rendered as soon as they receive said fiat currency. And instead electing to sit on part of their income as fiat currency savings in a bank. Which parks that fiat currency out of circulation, at least for a while, and thus contracts the circulating supply of fiat currency by expanding the parked supply of fiat currency. Which, in turn, makes it necessary for new fiat currency to be created and injected into circulation (by giving it to people and businesses who don't have fiat currency they would nevertheless like to spend and are willing to borrow it from a bank in order to spend it) to replace, in circulation, the fiat currency which has been parked, out of circulation, by people and business who keep at least part of their savings as fiat currency in a bank.

Yet another intrinsic, fundamental, systemic problem of the capitalist model is that fiat currency flows within it are uneven and asymmetric. For example, people pay more to businesses as payment for their goods or services than people receive back from businesses as wages, dividends, rent or royalties. This is because ALL businesses have at least expenses towards other businesses, such as suppliers and subcontractors, utilities companies. This means that people, as a whole and as a class of economic agent, pay more, on average, to businesses, as a whole and as a class of economic agent, than businesses pay back to people as wages, dividends, rent or royalties. The difference has to be perpetually made up from and through consumer credit. Which is people constantly borrowing money to make up the shortfall/discrepancy between what they need to pay for goods and services they need or want and what they themselves are paid.

>>509199627

There are 2 types of fiat currency:

1. Physical cash and coins printed, minted or coined by the central banks (or for them by private businesses under exclusivity contracts with the central banks).

2. Money of account. This is fictional cash and coins which don't exist physically and are just promises to pay cash or coins, in the same nominal amount, to the holder, on demand. They exist on the ledgers of the banking system.

Banks have been granted the right to "legally" deceive the entirety of society that the second type of fiat currency is the same as the first or that it doesn't exist, with the implication being that the second type of fiat currency is actually the first type when it really isn't. The proof that these two are not the same type of fiat currency, and also the proof that there is *A LOT* more of the second type in existence than the first, is that banks can run out of the first type of fiat currency to honour "withdrawal" requests against the second type, by depositors who think they're the same thing, and to avoid that happening, there are laws on the books in every country to force private individuals and businesses to store their physical fiat currency notes and coins, above a meagre amount, in banks and thus only use the second type of fiat currency for their larger transactions. In addition to this, convenience and online purchases ensure that most people prefer the second type of fiat currency.

While only central banks control the creation and issuance into circulation in the economy of the first type of fiat currency, any non-central bank anywhere can issue more of the second type of fiat currency into circulation. They do this by pretending to "lend" the first type of fiat currency to willing borrowers. But in actual fact, they just create more of the second type of fiat currency when they approve the "loan" (which is actually credit and not a loan) and issue it to the borrower. Or a credit card holder pays for something with it.

There are 2 types of fiat currency:

1. Physical cash and coins printed, minted or coined by the central banks (or for them by private businesses under exclusivity contracts with the central banks).

2. Money of account. This is fictional cash and coins which don't exist physically and are just promises to pay cash or coins, in the same nominal amount, to the holder, on demand. They exist on the ledgers of the banking system.

Banks have been granted the right to "legally" deceive the entirety of society that the second type of fiat currency is the same as the first or that it doesn't exist, with the implication being that the second type of fiat currency is actually the first type when it really isn't. The proof that these two are not the same type of fiat currency, and also the proof that there is *A LOT* more of the second type in existence than the first, is that banks can run out of the first type of fiat currency to honour "withdrawal" requests against the second type, by depositors who think they're the same thing, and to avoid that happening, there are laws on the books in every country to force private individuals and businesses to store their physical fiat currency notes and coins, above a meagre amount, in banks and thus only use the second type of fiat currency for their larger transactions. In addition to this, convenience and online purchases ensure that most people prefer the second type of fiat currency.

While only central banks control the creation and issuance into circulation in the economy of the first type of fiat currency, any non-central bank anywhere can issue more of the second type of fiat currency into circulation. They do this by pretending to "lend" the first type of fiat currency to willing borrowers. But in actual fact, they just create more of the second type of fiat currency when they approve the "loan" (which is actually credit and not a loan) and issue it to the borrower. Or a credit card holder pays for something with it.

>>508903475

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

>>508796061

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

>>508221231

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.

Capitalism is a jewish scam which runs on perpetual geometric expansion of the fiat currency supply and inevitably periodically fails through either hyperinflation or massive depression and cancellation of large swaths of the fiat currency supply, where the working class have their fiat savings cancelled in bank "failures" or "bail-ins", like in the Cyprus banking crisis.

Capitalism cannot afford to purchase its own aggregate internal production at a price which it is profitable to produce that output at, unless the money needed to constitute the profits is continually added to the system, such as by creating fiat currency (or more of it than is already in existence) or allowing counterfeiting or debasing of sound money such as silver coins, such as by reducing the purity or the weight of the coins.

However, the fiat creation needs to be continuous to enable continued capitalist production and the rate at which new fiat is created needs to accelerate (the growth needs to be geometric) or the rate of expansion of the fiat currency supply gradually approaches 0% of the already existing amount over time, as the supply grows, and so does the average possible rate of profit. Expanding the fiat supply from $10 trillion to $11 trillion within a year is a yearly growth of 10% but expanding it further, from $11 trillion to $12 trillion in the subsequent year is only a growth of 9.(09)%. For the fiat supply to grow another 10% in the second year, it needs to grow from $11 trillion to $12.1 trillion instead of just $12 trillion.

GDP is not economic activity but the estimated and inferred rate of spending of fiat per year.

Inflation, including due to scarcity - which forces people to spend their fiat savings into circulation, inflates the GDP. Deflation, including due to abundance, contracts the GDP.

Fiat currency is not wealth but merely claims on wealth.

Wealth is what you spend fiat currency on, not fiat currency itself.

Capitalism is not a closed loop or system.